There was an uptick in market volatility during August fuelled by increases in the yields of major sovereign bonds, continued Chinese economic weakness and an increase in natural gas prices due to the possibility of strikes at Australian liquified natural gas plants. Although they recovered towards the end of the month, both bonds and equities sold off globally.

Monthly Market Commentary – August 2023

LOCAL DRIVERS

BRICS Summit

Towards the end of August, the BRICS Summit was held in Johannesburg where leaders of the BRICS countries (except Putin) met to discuss the blocs progress and its future. It was announced that six countries will be joining the group in January 2024. These are Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates. Unfortunately, the criteria used to select these six countries has not yet been revealed however it is interesting to note that each of the countries admitted has China as their biggest import partner.

SA Inflation

The annual consumer inflation rate fell to 4.7% in July, down from 5.4% in June, the lowest reading since July 2021 and comfortably lower than expectations. The SARB’s Monetary Policy Committee (MPC) has stressed that it wants to see inflation sustainably around the midpoint of its target range, around 4.5%, before it contemplates rate cuts. Risks to the upside remain.

Fiscal Risks Steepen Yield Curve

As load shedding continues to choke off economic growth, government is experiencing rising costs and risks to revenues which has made market participants particularly nervy of longer dated bonds. Increased issuance risks and lower demand have resulted in a very steep yield curve with yields needing to rise ever higher to attract investment at the longer end of the curve.

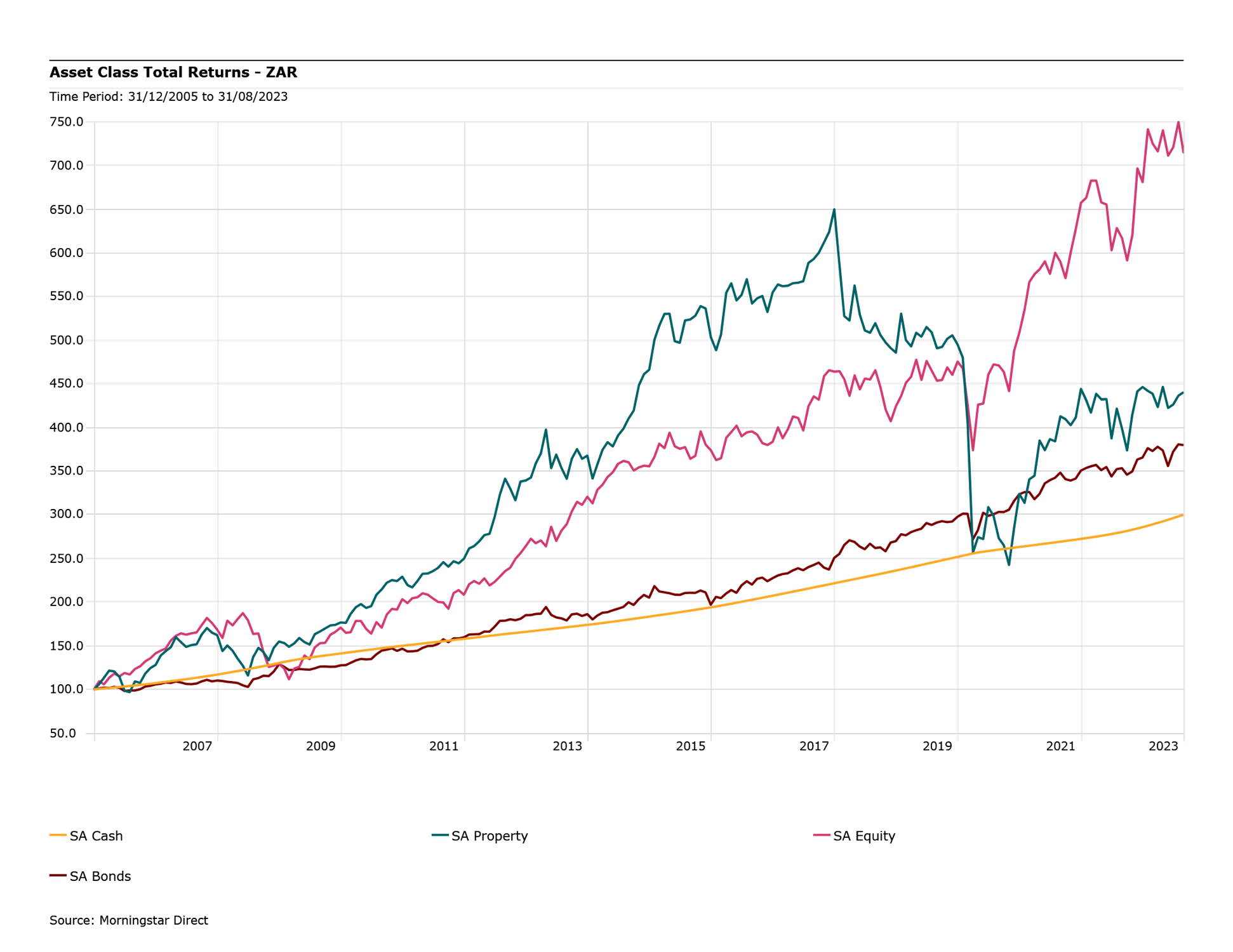

ASSET CLASS TOTAL RETURNS – ZAR

GLOBAL DRIVERS

US Downgrade

At the beginning of August, the US saw its credit rating downgraded by rating agency Fitch from the highest level AAA to the second highest AA+ given concerns around increased political dysfunction and the sustainability of debt and deficit trajectories. This may have had some bearing on the increase of US treasury yields later in the month, but these were probably more driven by strong economic data and higher treasury issuance.

China Wobbles

Chinese economic data was much weaker than expected. CPI turned negative in July at -0.3% year on year with producer price index deflation continuing for the 10th month in a row. Retail sales also badly missed expectations, growing 2.5% year on year vs. expectations of 4.5%, with consumer confidence remaining low. Symptomatic of problems in the property sector, two of its biggest developers suffered further issues during the month with Evergrande entering bankruptcy and Country Garden missing bond interest payments.

Japan Improvement

The Japanese economy expanded 6% quarter on quarter during Q2 2023, although this was due to strong net trade which masked weaker domestic demand. Nevertheless, business surveys remain strong with inflation rising to 4.3% year on year in July and wage negotiations leading to the biggest wage increases in 30 years (in contrast to most other countries, higher inflation is positive in Japan given its desire to break free from its deflationary past).

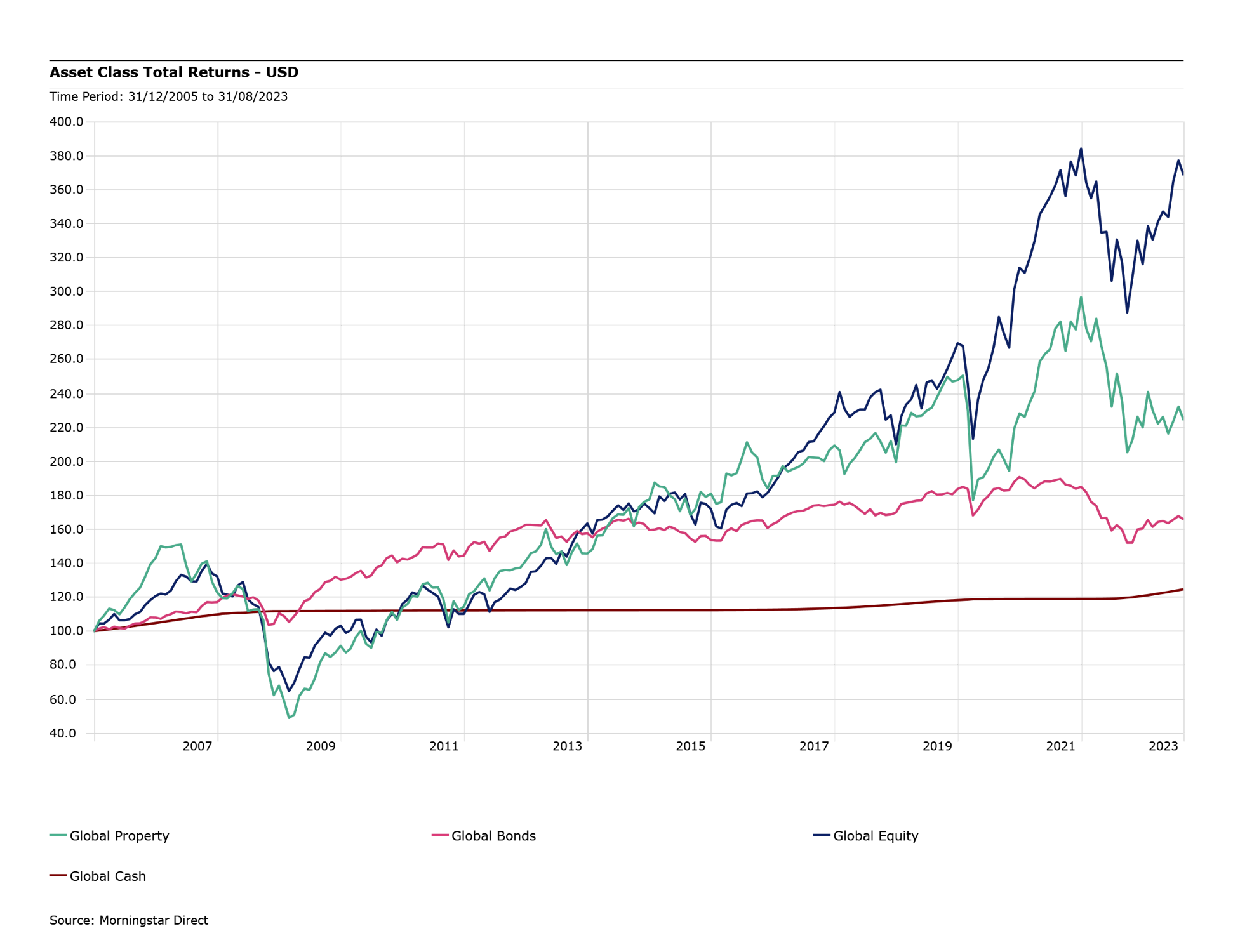

ASSET CLASS TOTAL RETURNS – USD

All information provided courtesy of Portfolio Metrix – adapted and published with permission. No copyright infringement intended.

SHARE THIS ARTICLE