A continuation of the strong US earnings season and stronger US economic data reignited market confidence from the end of last year. Business optimism appears to have returned to the US and, alongside signs of slightly stickier inflation, expectations for when the interest rate cutting cycle will begin were pushed out. The UK fell into a technical recession, but again there are signs that businesses are resilient, pointing to the likelihood of a very shallow and short recession. Broadly positive economic news fed through to stronger equity markets, whilst bonds fell slightly as the prospects of interest rate cuts were pushed out.

Monthly Market Commentary – February 2024

LOCAL DRIVERS

Treasury Taps into GFECRA

The SARB will transfer R250bn to the Treasury of which R150bn will be used to reduce debt over the next three years. The Gold and Foreign Exchange Contingency Reserve Account (GFECRA) has grown substantially over the years (mainly due to a weakening currency and appreciation in the gold price) resulting in it becoming sizable as a percentage of GDP relative to global norms. The GFECRA withdrawal will be formalised through legislation, and through a framework agreed upon between the National Treasury and the SARB. This resulted in the outlook for debt-to-GDP of the country improving from the MTBPS. However, the move is a “once off” that cannot be repeated in the short to medium term. Fundamentally the country requires growth.

Transnet Leadership

State owned logistics firm, Transnet, appointed Michelle Phillips as CEO after she had been acting CEO of freight rail, ports and pipelines utility since November. The move was seen as broadly positive by business, a rarity in South Africa, particularly given prior dubious appointments at SOE’s in the past. Logistic backlogs are a major hindrance to growth for the country and significant changes are needed to ensure smooth functioning of the economy.

South Africa Inflation

South Africa’s headline consumer inflation quickened to 5.3% year on year in January from 5.1% in December. Key contributors to the annual inflation rate included food, housing, utilities and transport. With the SARB wanting to see a clearer trend of disinflation, it is unlikely we will see a rate cut in the first half of the year.

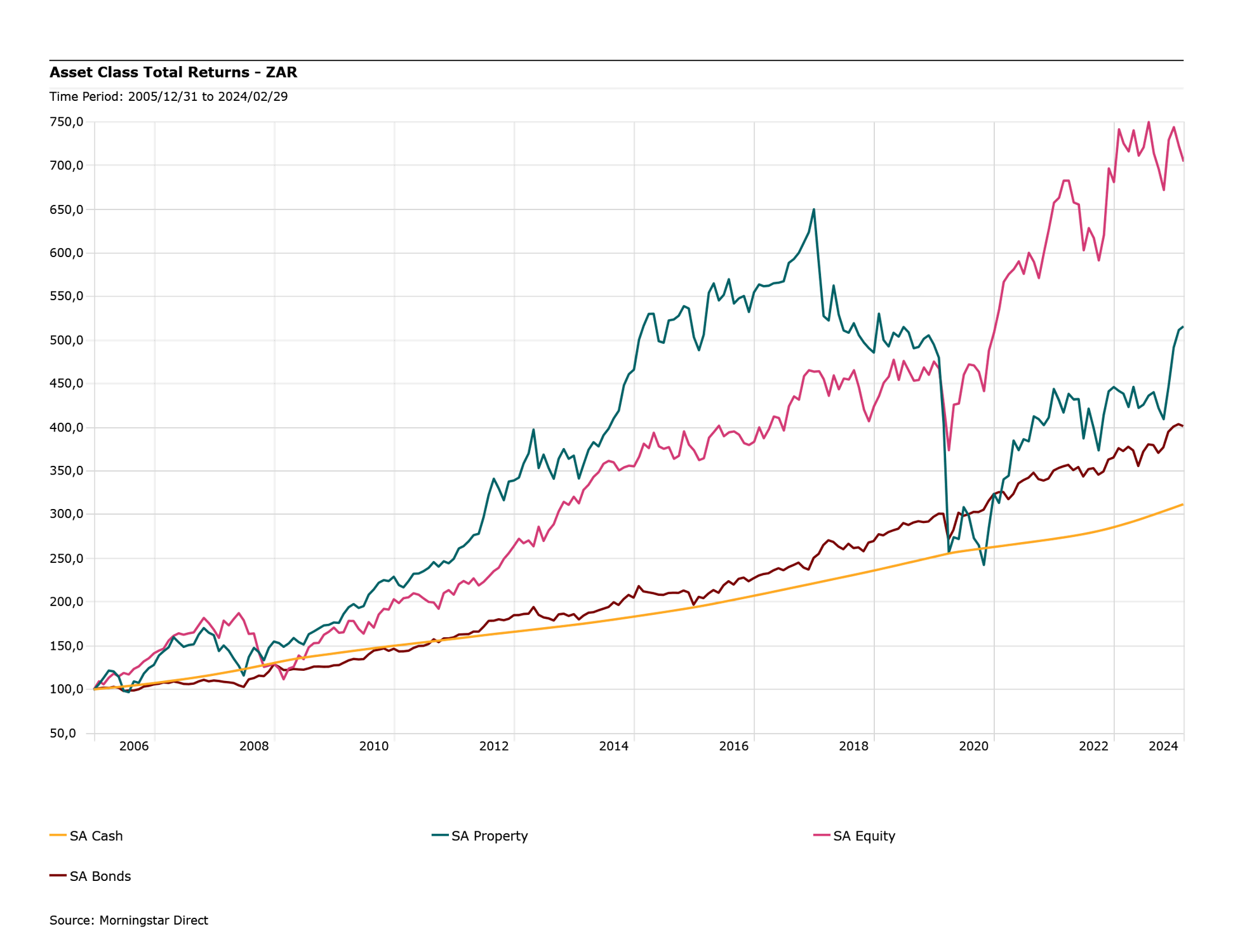

ASSET CLASS TOTAL RETURNS – ZAR

GLOBAL DRIVERS

US Earnings Season

In the US, the strong earnings season continued as further evidence of economic resiliency boosted spirits. 4 of the ‘magnificent 7’ stocks reported earnings in February, all stronger than expected. And the record for the largest daily market cap increase by a single company was broken twice this month, firstly by Meta (+$197bn), on February 2nd, swiftly surpassed by NVIDIA (+$247bn) on February 22nd, both the day after their earnings releases. In total around 75% of companies have beaten earnings expectations this quarter.

Euro Area Slight Improvement

The euro area started to show some more signs of an improving economy in February. Inflation fell to 2.8% in January, from 2.9% in December, in-line with expectations. Core inflation also ticked down to 3.3% in January, from 3.4% the prior month. Alongside prices falling, households were also cheered by a fall in unemployment to 6.4% in January, the lowest figure since records began. And businesses also appeared to be getting more optimistic about the future as composite PMI for February was 48.9, up from 47.9 in January. This was driven by a strong bounce in services activity, reaching 50 compared to 48.4 in January and well above expectations of 48.8. In contrast though, manufacturing dipped a little.

China Stimulus

China saw a slight improvement in sentiment after further efforts to support the economy and market. A number of announcements were made including: reducing the reference rate for mortgages (by 0.25%); clamping down on short selling; and directing state-owned investment firms to buy up stocks of banks and other large firms.

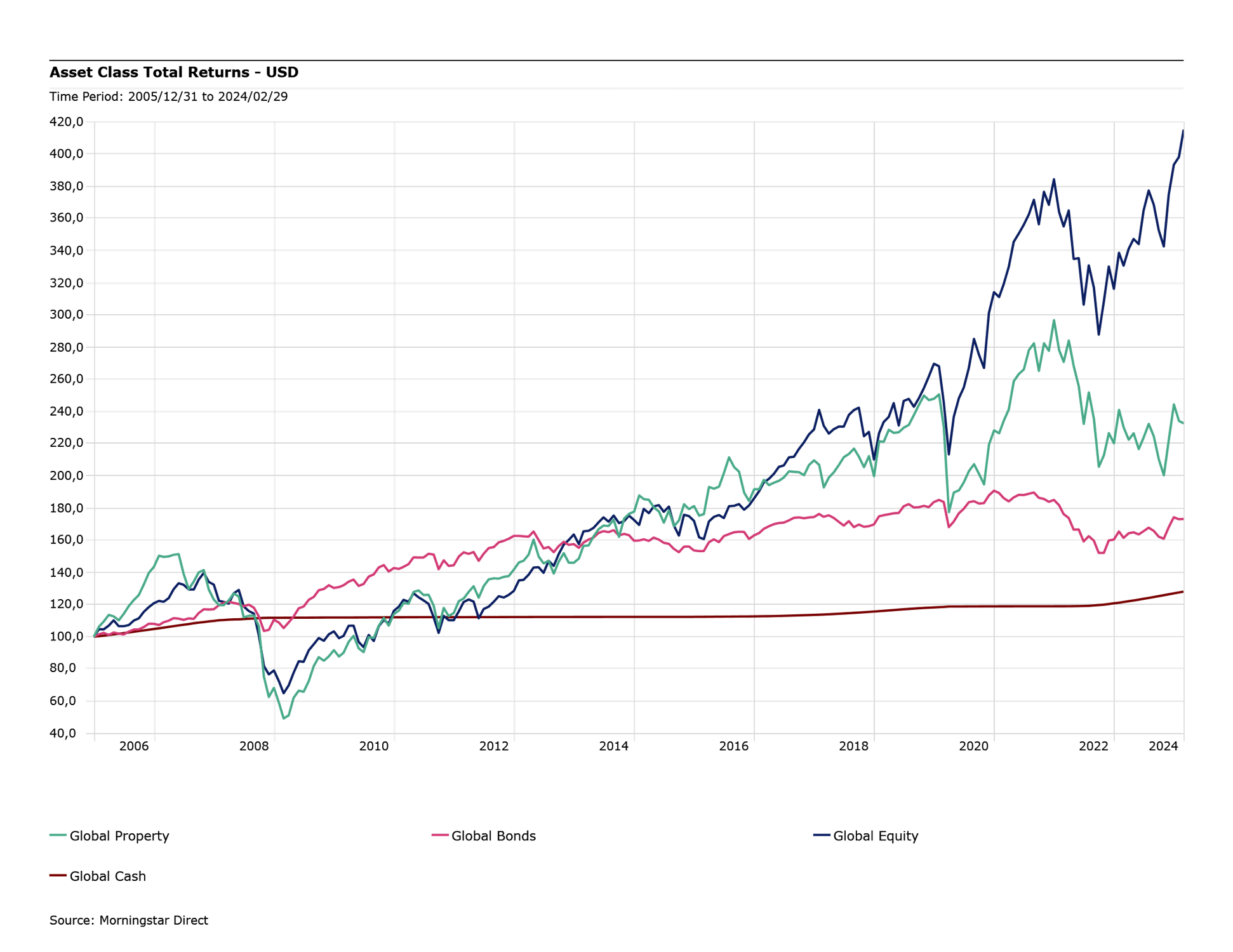

ASSET CLASS TOTAL RETURNS – USD

All information provided courtesy of Portfolio Metrix – adapted and published with permission. No copyright infringement intended.

SHARE THIS ARTICLE