The most expensive word in investing: “Later”Speed read“Later” can feel cautious in uncertain markets, but it can also create a re-entry challenge. Changing between invested and divested may influence long-term outcomes, depending on timing, market conditions and individual circumstances. One way to reduce the impact is a robust portfolio design process – to help when the world becomes noisy. Diversified portfolios are built to consider different market climates and are aligned to the investor’s objectives, risk tolerance and time horizon.

|

Monthly Market Commentary – January 2026

LOCAL DRIVERS

Emerging Market Rally and Rand Strength

South Africa benefitted from a broader emerging-market rally, supported by a weaker US dollar, firmer commodity prices and renewed global risk appetite. The rand strengthened in to R17.20/$, aided by continued foreign demand for high real-yield local bonds and money-market assets. While the move was largely driven by global capital flows rather than domestic growth fundamentals, a firmer currency helped contain imported inflation pressures and supported confidence in South African assets. The rand’s performance remains highly sensitive to shifts in global sentiment, highlighting the external nature of this suppor

SA Macro Stability: Low Infaltion

December headline CPI was 3.6% y/y, placing it comfortably within the SARB’s newly emphasised 2–4% inflation range. Easing food and fuel price pressures, alongside disciplined monetary policy, have helped pull inflation expectations steadily lower toward 3%, reinforcing the credibility of the revised inflation regime. Against this backdrop, the SARB maintained a cautious but increasingly supportive stance, signalling that real interest rates are sufficiently restrictive and that policy flexibility could increase if conditions allow. This environment has been constructive for bond markets, household purchasing power and interest-rate-sensitive sectors of the economy

Structural Reforms and Investment Climate Improvements

Incremental progress on structural reforms continued to shape South Africa’s medium-term outlook, particularly in electricity and logistics under Operation Vulindlela. Ongoing steps to expand private power generation capacity and advance port and rail concessions aim to ease long-standing constraints that have capped growth. Government has reiterated infrastructure commitments exceeding R1 trillion over the medium term, while multilateral funding support has helped de-risk priority projects. Although implementation remains uneven, steady reform momentum has improved investor sentiment and strengthened expectations that South Africa’s growth ceiling can gradually lift if execution continues.

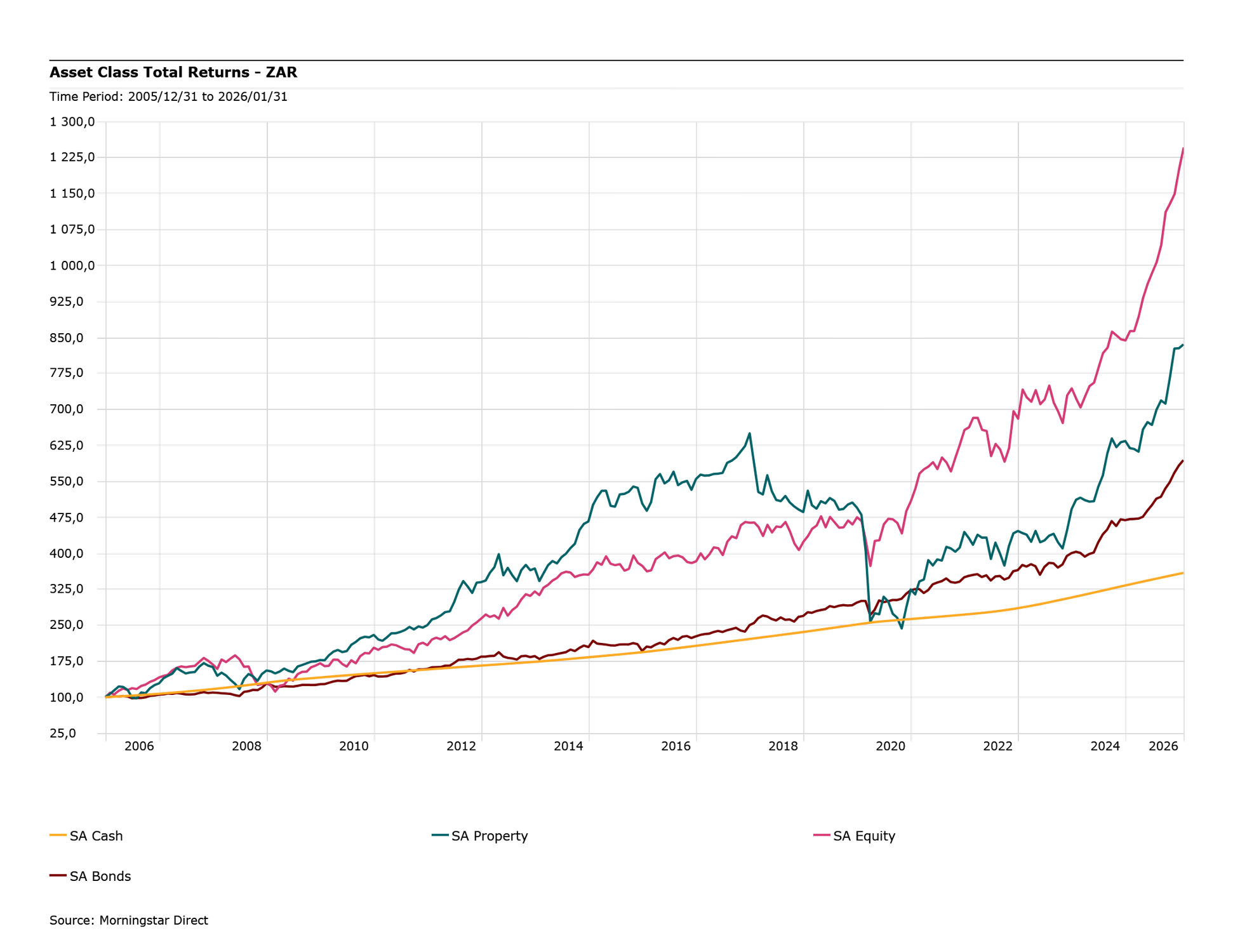

ASSET CLASS TOTAL RETURNS – ZAR

GLOBAL DRIVERS

Global Monetary Policy Divergence

January reinforced monetary policy divergence across major economies as inflation and growth dynamics evolved unevenly. The US Fed kept policy rates at 3.5-3.75%, signalling patience amid resilient labour markets and sticky services inflation. Parts of Europe remained cautious as weak growth offset easing price pressures, while several emerging-market central banks leaned toward earlier easing as inflation moderated faster. This divergence widened interest-rate differentials, driving FX volatility, capital flows and relative bond and equity performance. As a result, policy expectations remained the most powerful macro force affecting global asset pricing during the month.

Emerging Markets Lead Global Growth Projections

Global growth expectations pointed to continued rebalancing toward emerging markets, with Asia projected to deliver over half of incremental global GDP growth. Advanced Economies (Europe, UK, USA) are expected to grow slower, around 1.8%, constrained by tighter financial conditions and fiscal consolidation. In contrast, Emerging Economies (Asia, Lat. America, Africa) are expected to grow faster at 4.2%, supported by domestic demand and structural investment. China’s outlook remained stable but modest, reflecting targeted rather than aggressive policy support. This uneven growth backdrop encouraged capital rotation toward emerging markets and commodities, driving relative performance across regions and sectors.

Geopolitical Risk, Trade Policy and Market Volatility

Geopolitical risk remained a source of volatility, periodically disrupting otherwise supportive macro trends. Uncertainty around trade policy, supply chains and regional conflicts contributed to episodic risk-off moves, spikes in volatility and renewed demand for safe-haven assets such as gold and government bonds. Commodity markets were particularly sensitive, with oil and precious metals reacting sharply to geopolitical headlines despite broadly balanced fundamentals. While these developments did not materially alter the global growth outlook, they increased risk premia and short-term market instability, acting primarily as a volatility amplifier rather than a sustained directional driver.

ASSET CLASS TOTAL RETURNS – USD

SHARE THIS ARTICLE