How to write your Lifestyle Plan

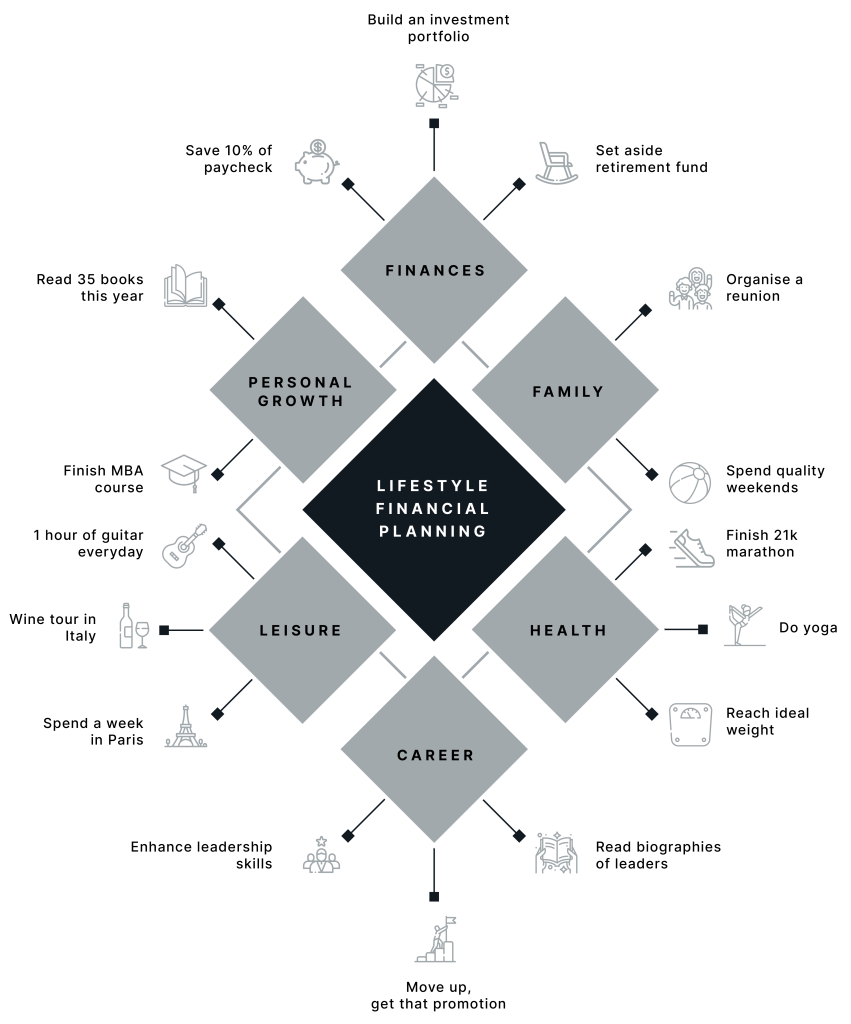

Your Lifestyle Plan will include descriptions of all the above elements, as well as thoughtful, in-depth answers to all of the listed questions. We also encourage you to add in your own questions and probe further, until you are certain you have a solid vision of your ideal lifestyle and why it is important to you.

Then, on a new page, detail where you are currently at in relation to these aspects of your life. Having done both, you will now have a good idea of where you are and where you want to be. You will also be able to assess the different tools and options available to you, from within this functional context, and ascertain which are most likely to help you move from your present reality into your ideal future.

Knowing where to find, and how to understand, all of the different tools and options can be challenging. Speaking to a professional Lifestyle Planner can go a long way toward getting you on the path to success.

At Cornerstone Financial Services Group, our dedicated Lifestyle Financial Planners are up-to-date on all the latest tools and developments available on the market. We’re proudly independent, and therefore free to prioritise the products best suited to our individual clients, rather than being beholden to a service provider. We build life-long relationships with our clients and their businesses, offering a completely personalised service. There is no one-size-fits-all approach.

We offer you total lifestyle and financial planning expertise under one roof: Lifestyle Financial Planning, Investment Advisory, Tax & Accounting Services, Healthcare Consulting, Fiduciary Services, Insurance Brokers, and Employee Benefits.

Click here to learn more.