What We Know for Sure: How Uncertainty Distorts Decision-Making

Geopolitical risk is grabbing headlines again. In today’s investment climate, it’s tempting to fixate on the big geopolitical question marks: Will Trump’s policies unseat the US dollar as the global reserve currency? How far will China go in asserting regional / global dominance? Can Europe hold its fragile unity? These are captivating storylines, but they come with a trap—they’re unknowable. For advisers guiding clients through volatility, the smarter conversation is not about what might happen, but what we know is already true.

And what we know is this: uncertainty has real economic costs, but its effects don’t always translate predictably into markets. Markets don’t always behave the way we’d expect.

The Real Cost of Uncertainty

When the policy environment becomes unpredictable—when rules change abruptly, processes are bypassed, or institutions lose their footing—companies hesitate. Long-term investment plans are postponed. Hiring slows. Supply chains are re-evaluated. The decision to locate production in one country over another might hinge not on cost, but on clarity and consistency of regulation. Companies don’t stop because they’re pessimistic. They stop because they can’t model the future.

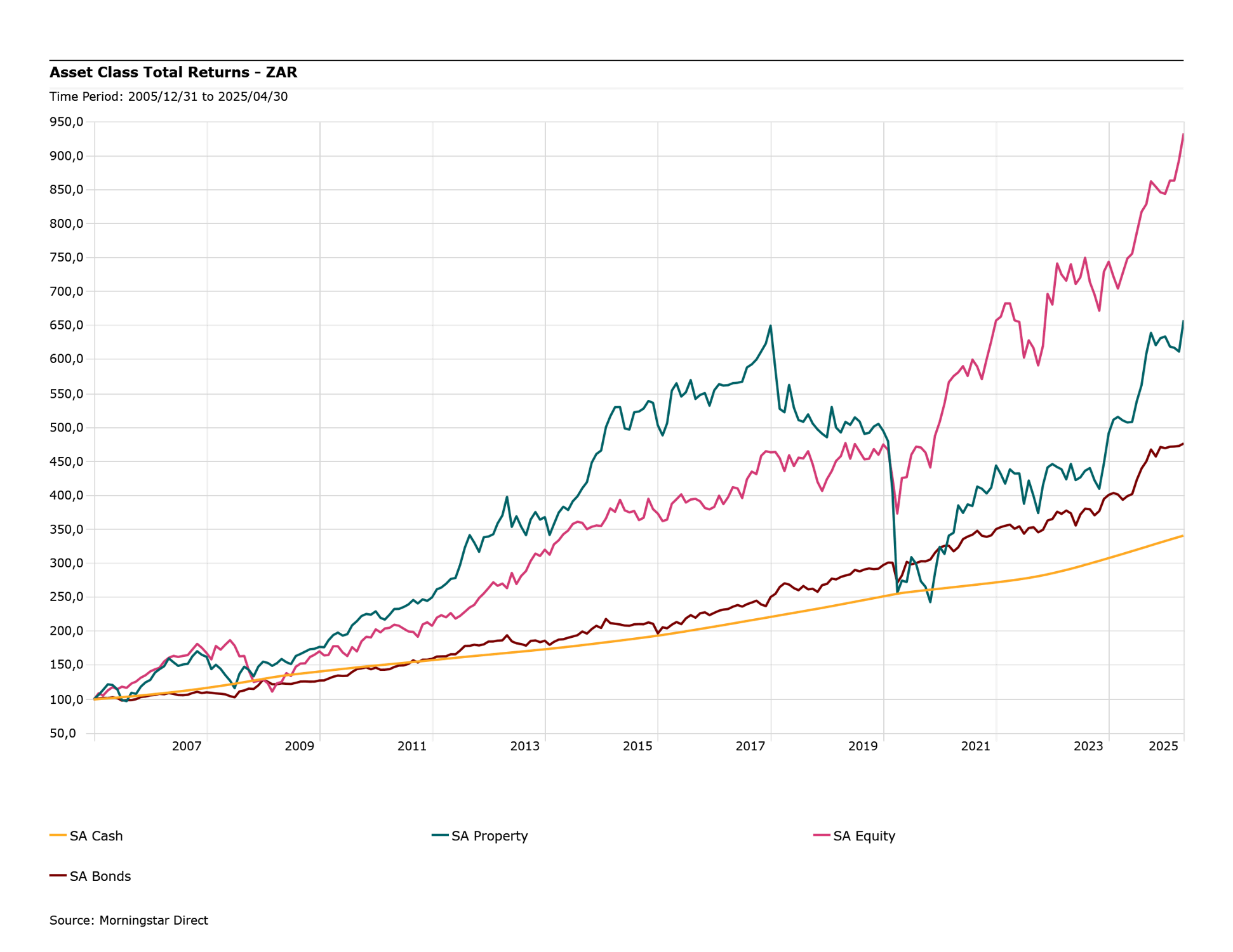

This is not hypothetical. The chart below shows the Global Economic Policy Uncertainty Index, which has surged to unprecedented highs recently, surpassing even the peaks of the global financial crisis and the COVID pandemic. These are not isolated blips; they reflect sustained anxiety over trade tensions, geopolitical fragmentation, and unpredictable policy shifts. Studies by the Federal Reserve and the IMF have shown that investment spending slows sharply when policy uncertainty rises.

Figure 1: Global Economic Policy Uncertainty Index

Source: https://fred.stlouisfed.org/series/GEPUCURRENT

It’s not just about tariffs or taxes; it’s about whether the rules of the game will still apply next year. Consumers, too, respond to policy fog by tightening their belts. They delay buying homes or cars. They stay in their jobs longer. The cumulative effect of deferred decisions can quietly sap growth from the real economy.

Institutions Matter More Than Forecasts

If we can’t forecast policy, what can we trust? The strength of institutions.

Independent central banks, predictable legal systems, and transparent regulatory processes are not exciting headline topics—but they’re the foundations of investor confidence. They reduce uncertainty by anchoring expectations, even when the political cycle is noisy.

This is why investors differentiate sharply between countries that have robust institutions and those that don’t. It’s not just about GDP or debt levels; it’s about trust in the system. Strong institutions turn ambiguity into risk—something markets can price. Weak institutions turn it into uncertainty—something they can’t. Credibility, not just numbers, matters.

Arbitrariness Is More Damaging Than Bad Policy

Ironically, even bad policy can be better than arbitrary policy. Poor decisions can be modelled, priced, and accounted for. Arbitrariness cannot. When companies feel that decisions are driven by personalities, short-term political pressure, or opaque backchannels, they lose the ability to plan.

This is as true for global multinationals as it is for mid-sized firms trying to navigate cross-border operations or shifting tax codes. The drag on capital expenditure, hiring, and innovation is not ideological—it’s operational. Uncertainty doesn’t discriminate.

Wall Street Is Not High Street

But here’s the paradox: even when uncertainty drags on the real economy, markets may shrug—or even rally.

Why?

Because markets are forward-looking. They don’t trade on how the real economy feels today; they trade on how it might evolve six, twelve, or twenty-four months from now. Sometimes they anticipate a policy breakthrough. Sometimes they expect a rate cut. Sometimes, frankly, they just have too much liquidity chasing too few assets.

This disconnect between High Street and Wall Street can be confounding. A company may be cutting jobs while its share price soars. A country may be in recession while its stock market hits all-time highs. These are not contradictions—they’re reflections of different timeframes, different incentives, and different mechanisms of price discovery.

For advisers, the lesson is not to ignore the economy, but to recognise that understanding it does not automatically yield insight into markets. Clients who believe that “the bad news hasn’t hit the market yet” may not realise that markets already priced it—or have chosen to look past it.

The Adviser’s Role: Framing, Not Forecasting

This is where the adviser becomes indispensable—not for predicting the next twist in monetary policy or geopolitics, but for helping clients frame their decisions appropriately.

What do we know?

• Uncertainty tends to reduce real-world investment appetite.

• Strong institutions reduce uncertainty and support long-term confidence.

• Markets can rally even when the economy is soft—because they’re forward-looking.

• Composure and diversification remain the strongest defences against arbitrary shocks.

Trying to “trade” uncertainty is a fool’s errand. Building a strategy that acknowledges it, adapts to it, and remains robust through it—that’s a different story.

Conclusion: Stick to the Plan

In uncertain times, there is often a hunger for certainty. But the wise investor—and the wise adviser—knows that chasing certainty is not the same as managing risk.

The client who reads today’s headlines and wants to change their portfolio is not irrational—they’re human. The adviser who can separate story from signal, speculation from structure, isn’t just delivering performance, they’re delivering perspective, adding value far beyond the latest market update.

The takeaway is not to disengage from the world—but to interpret it more intelligently. We don’t need to know how the story ends to know how to stay in character.

Stay composed. Stay invested. Stay strategic.