The last month of the year saw a ‘Santa rally’ across markets as investors became increasingly certain of forthcoming interest rate cuts. Three of the major developed economic areas (UK, US and euro area) all had positive news on this front, either lower than expected inflation numbers, or central banks signaling the end of the rate hiking cycle and the green shoots of monetary policy easing on the horizon. This provided a boost to asset prices across developed and emerging markets with bond yields falling, and thus bond prices rising, in anticipation of lower interest rates. Equities were buoyed by lower expected funding costs and a further uplift in positive sentiment.

Monthly Market Commentary – December 2023

LOCAL DRIVERS

SA Economy Slips

South Africa’s economy contracted in the third quarter of 2023 by 0.2% q-o-q. This was marginally lower than expected and came off the back of tepid growth of 0.5% in the second quarter. Agriculture, construction, mining, and manufacturing had the biggest falls in output. Given that these sectors employ a large amount of the workforce (particularly unskilled), their poor performance raises concerns about the risk of job losses and what that might mean for an already very high unemployment rate. Reasons for poor growth are well known however, contributing factors to poor performance from agriculture came from avian flu and floods in the Western Cape.

SA Inflation Cools

After three consecutive months of increasing annual inflation rates, the figure for November fell from 5.9% to 5.5%. The main contributor to the downward trajectory came from lower fuel prices which outweighed still-rising food costs. Core inflation (excludes food and fuel) rose slightly to 4.5% from 4.4% in October.

SA Current Account Deficit Narrows

The current account deficit for South Africa narrowed in the third quarter from R185.2bn to R19.3bn. This equates to a fall in the current account deficit as a percentage of GDP to 0.3% from 2.7%. The largest contributor to the decline was a sharp fall in import volumes due to weak demand and logistics bottlenecks. This was the largest drop in imports since June 2020 when countries worldwide were in the grip of covid lockdowns.

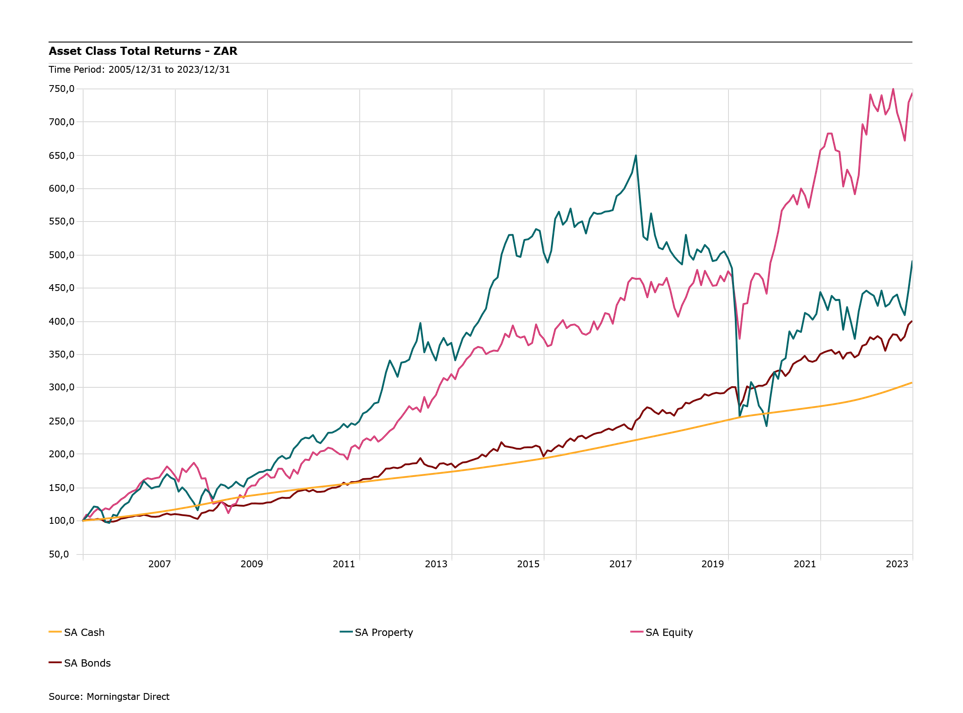

ASSET CLASS TOTAL RETURNS – ZAR

GLOBAL DRIVERS

US Rates

In the US, communication from the Federal Open Market Committee (FOMC) members was the biggest market-moving news during December. The FOMC maintained rates between 5.25-5.5%, but in the meeting minutes and press conference referenced that US rates had peaked, and the committee expected three rate cuts during 2024 (markets expect this to be closer to seven rate cuts). This, alongside broadly positive data releases during December, boosted market sentiment.

Key US Data

Headline inflation dipped marginally to 3.1% in November (from 3.2% in October), in-line with expectations; whilst Core PCE (Personal Consumption expenditures), the FOMC’s favoured inflation measure, dropped to 3.2%, slightly below expectations. In labour markets, conditions improved slightly as unemployment fell to 3.7% in November (below expectations of 3.9%) and 199,000 new jobs were created in November. Composite PMI nudged up to 51 in December, from 50.7 in November with a small tick-up in services more than making up for a fall in manufacturing activity.

China Lag Continues

In Emerging Markets, there were mixed messages on data releases for the region’s powerhouse, China. Composite PMI jumped up to 51.6 again in November following a one-month stagnation stint (50.0) during October. But deflation remained, falling further to -0.5% in November, from -0.2% in October. Property investment concerns continued with investment almost 10% down year on year.

ASSET CLASS TOTAL RETURNS – USD

All information provided courtesy of Portfolio Metrix – adapted and published with permission. No copyright infringement intended.

SHARE THIS ARTICLE