New Year, Not So New US President: Trump 2.0, Tariffs & Inflation

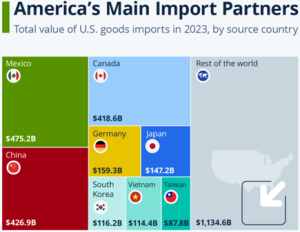

We enter a new year with Donald Trump set to return to the White House on January 20th. Despite this being a couple of weeks away, the incoming President has made plenty of headlines with his “America First” agenda, particularly his threats of tariffs on a number of US trading partners – with China, the Eurozone, Canada and Mexico all being targeted over December. This month, we examine what a trade tariff is, the tariffs Trump has threatened and their potential impacts on markets and inflation, and how we are managing these risks in portfolios.

Understanding Trade Tariffs

In simple terms, a trade tariff is a tax imposed on goods and services imported from another country. The tax raises the cost of these imports, making them less attractive to domestic consumers. Tariffs can serve various purposes such as protecting domestic industries, generating revenue or exerting political leverage.

What Trade Tariffs has Trump Threatened?

Donald Trump continually referred to tariffs over the course of his campaign and has continued to do so since his election victory in November – at one point even referring to tariffs as “the most beautiful word in the dictionary”. Over this period, he has threatened tariffs against several nations such as:

- A 25% Tariff on all goods imported from Mexico and Canada in response to irregular border crossings and drug trafficking

- Up to 60% Tariff on all goods imported from China to raise revenue and increase manufacturing jobs in the United States

- Tariffs on the European Union if the bloc does not address the “tremendous” trade deficit with the United States. Most recently demanding the EU purchases more US oil & gas.

100% Tariff on BRICS nations (a group of 9 countries which includes Russia, Brazil & China) if they try to replace the US dollar as the global reserve currency.

At this stage, all of these proposals are just threats, and history has shown that rarely do all proposed policies make it into law. During his previous presidency, Trump only implemented tariffs on 14% of goods imported to the US, despite promising tariffs on 100% of imported goods.

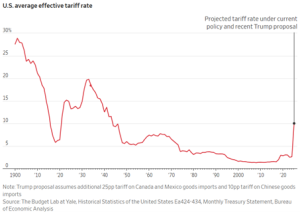

However, should Trump implement all tariffs he has threatened so far, it would take the effective tariff rate in the US to around 10% – the highest since the 1940s.

Impact on Inflation, Markets & Portfolio Positioning

Market commentators and economists have written at length about the negative impacts of the tariffs threatened by Trump on the Global Economy, Inflation and Financial Markets. This is despite the fact the actual tariffs at this stage remain completely unknown.

Donald Trump’s tariff threat adds to fears over China growth

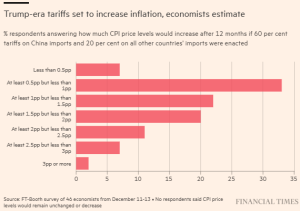

One major area of concern is the additional inflationary pressures tariffs may exert on the US economy – at a time when the US Fed is still grappling with bringing inflation back to its 2% target. The majority of Economists estimate that in a worst-case scenario, where Trump imposes 60% tariffs on China, and 20% on imports from the rest of the world, inflation could be between 0.5% and 3% higher in 12 months’ time.

While these estimates may seem scary at a headline level, it’s important to remember these predictions are based on worst case scenarios and as history has shown us, US Presidents are almost never able to push through all the policies they would like to – not even Donald Trump. So, the worst-case scenario appears unlikely.

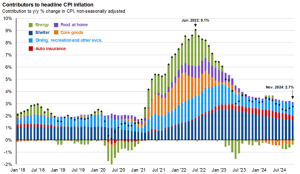

It’s also important to remember that economist forecasts ignore the other components of inflation that aren’t impacted by tariffs, such as shelter. Shelter has historically been a large contributor to inflation in the US (dark blue areas below), and one which economists have consistently forecasted incorrectly. This serves as a reminder that the overall inflation picture is much more complex than tariffs alone, and being overly focused on a single factor may result in another factor being missed completely.

Forecasting the impact of Trump’s Tariffs and the impact on portfolios therefore, requires you to firstly, correctly predict the actual tariffs that are implemented, and secondly, correctly predict how the market will react to them. Both of these are near impossible tasks, and we have seen time and time again, that markets do not always react in the way you would expect them to. On top of this, and at the same time, one must hope no other surprises occur over the same time period.

What does appear clear is that tariffs are coming, and this will likely bring market volatility with it as they are announced. However, all other market participants know this too, and given markets are somewhat efficient, tariffs will have already been partially priced in. Therefore, if tariffs are lower than expected, the impacted markets may actually perform quite well.

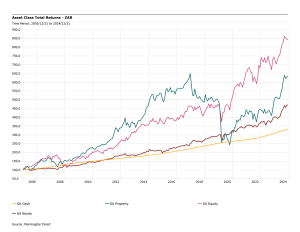

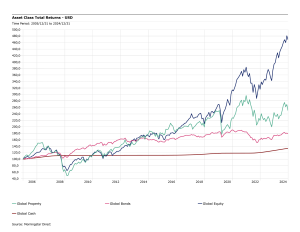

So, instead of trying to predict who the winners and losers will be from Trump’s Tariffs, we prefer to focus on understanding the risks within portfolios and ensuring that portfolios aren’t over or underexposed to single macro-related events. By maintaining diversification across asset classes, and not introducing binary bets into portfolios, we aim to give your portfolios the best chance of performing well regardless of what markets (or Trump) throws our way.