When concentration isn’t the enemyKey takeaways

Why market leadership is often a feature, not a flaw Market concentration is often viewed as a warning sign, particularly from a portfolio risk perspective. Periods where a small number of companies dominate index weights, drive market returns, and attract the bulk of investor attention are typically interpreted as a signal that risk is rising, prompting some investors to reduce exposure. While this concern is understandable, it is also incomplete. A growing body of evidence suggests that market concentration is not inherently a risk in and of itself. In many cases, it reflects the way markets allocate capital over time, rewarding strong fundamentals, reinforcing successful business models, and allowing leading companies to grow. The more important question for investors is not whether markets are concentrated, but what is the nature of that concentration and how is it managed within a well-constructed portfolio.

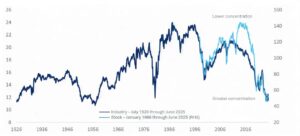

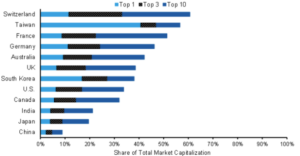

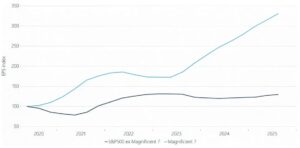

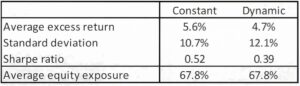

Concentration is not new and not unusual While today’s market leadership may feel unprecedented, history suggests otherwise. Periods of elevated concentration have occurred many times before, often during phases of technological change, productivity growth, or major economic transitions. Chart 1: Shifts in Industry and stock concentration in the S&P500 Source: StateStreet: “The Fallacy of Concentration”. Lower values imply greater concentration The chart above shows that the US equity market has indeed become more concentrated in recent years, driven both by industry effects (notably technology) and by individual stock effects. However, measured over long history, today’s concentration is not unprecedented and sits well within historical experience. The US market is not an outlier globally Another common misconception is that concentration is a uniquely US phenomenon. Chart 2: Stock market concentration in the largest global equity markets Source: Counterpoint Global, FactSet. As at 30/09/2025 When compared internationally, the US equity market sits around the middle of the pack, with several developed markets exhibiting higher levels of concentration. Seen in a global context, concentration is a normal feature of equity markets rather than a sign of excess. Many highly concentrated markets continue to function efficiently, providing diversification and long-term growth opportunities Why concentration emerges in the first place Markets are not designed to distribute capital evenly. They are designed to allocate capital towards the most successful businesses. As companies grow, they attract capital, talent, and customers. Success reinforces success. Over time, this leads to a skewed distribution of market capitalisation, where a small number of companies represent a large share of the index. For example, the Magnificent 7’s EPS growth (12 months trailing) has more than tripled in the last five years, leaving the EPS growth for the other S&P 500 companies in the shade. Chart 3: EPS growth: magnificent 7 vs the rest of the S&P500 constituents Source: Bloomberg, Barclays Private Bank. September 2025 A small number of companies naturally account for a large share of total market value, a pattern seen across industries, economies, and time. This dynamic is not an aberration. It reflects the same forces that drive concentration in wealth, income, and innovation more broadly. Concentration, in this sense, is a consequence of growth, not a warning sign. Does concentration actually increase risk? This is the most important question and where intuition often diverges from evidence. In State Street’s study, “The Fallacy of Concentration”, they tested a simple but powerful idea: if concentration truly increases risk, then reducing equity exposure when markets become more concentrated should improve outcomes. It did not. Table 1 and Chart 4 below, show the results of a dynamic trading rule compared to a buy-and-hold strategy. Table 1: Return and risk of constant and dynamic strategies

Source: StateStreet: “The Fallacy of Concentration The strategy that cut equity exposure when markets become more concentrated historically delivered lower returns and higher volatility than staying invested. Allowing markets to evolve naturally, without mechanically adjusting exposure in response to concentration, has tended to produce better long-term outcomes. That said, concentration is not without risk. While it often reflects underlying fundamentals, periods of elevated concentration can still amplify downside risk under adverse regulatory, technological or macroeconomic shocks, particularly when correlations across markets rise. As with all portfolio considerations, the key is not to eliminate concentration, but to understand it and manage it deliberately within the context of broader diversification and risk controls. To further assess concentration as a driver of market risk, Chart 5 shows the rolling volatility of a capitalisation-weighted U.S. equity index relative to an equal-weighted index. If higher concentration had led to increased equity market risk, we would expect to see a rise in relative risk from 2015 through 2024, but this has not been the case. Chart 5: Relative volatility of cap- and equal-weighted U.S. equities

Source: AQR, MSCI. Chart shows ratio of volatilities of MSCI U.S. Cap-Weighted and Equal-Weighted indices, based on monthly data. A ratio trending upwards would suggest that the cap-weighted index is becoming relatively riskier. Daily data shows a similar pattern. Jan 1, 1975 – Dec 31, 2024 Concentration reflects earnings power, not speculation Another common concern is that concentration is driven by sentiment rather than fundamentals. However, the largest companies account for a disproportionately large share of total earnings and economic profit, often far exceeding their share of index weights. In 2023 for instance, the top 10 stocks made up 27 percent of the US market capitalisation, while earning 69 percent of the markets economic profit. Chart 6: Economic profit of top 10 by market cap and of rest of universe (USA)

Source: Counterpoint Global and FactSet.2014-2023 In other words, market leadership is not arbitrary. The largest companies tend to generate substantial cash flows, reinvest heavily, and earn returns that justify their size. Concentration often reflects fundamentals catching up with success. Large companies are not “single bets” It is easy to think of large index constituents as concentrated exposures. In reality, many of the world’s largest companies resemble diversified portfolios in their own right. These businesses typically operate across multiple geographies, serve a wide range of customers, and offer a broad mix of products and services. Their revenues are not reliant on a single market, client, or outcome. Size also brings flexibility. Large companies tend to have greater financial resources, more established supply chains, and the ability to adapt when conditions change, whether by adjusting investment plans, reallocating capital, or streamlining operations. For investors, this means that exposure to large companies is often exposure to a broad set of economic activities, rather than a narrow or fragile bet. In many cases, scale can act as a stabilising force rather than a source of risk. Markets already price concentration High market concentration is often interpreted as a warning sign for future returns. In practice, the historical relationship has been relatively weak. Periods when a small group of companies has dominated the market have been followed by a wide range of outcomes, with no clear pattern in subsequent returns. Where risks have emerged, they have usually been driven by broader market conditions rather than concentration itself. Ultimately, it is changes in business fundamentals and investor expectations that shape market outcomes, neither of which automatically deteriorate simply because market leadership becomes more concentrated. Chart 7: Market concentration versus one-year forward S&P 500 returns

Source: Bloomberg, Barclays Private Bank. September 2025 What this means for investors None of this suggests that diversification is unimportant, it remains a cornerstone of sound portfolio construction. However, portfolio responses to concentration should be deliberate and aligned to investor objectives, constraints and risk tolerance, rather than mechanically driven. Reducing exposure solely because market leadership has narrowed, risks under-allocating to the most profitable businesses, increasing turnover and behavioural mistakes, and sacrificing returns without meaningfully reducing risk. Concentration itself is not a market flaw, but often the visible outcome of innovation, productivity, and competitive advantage at work. History shows that it is a recurring feature of markets, does not reliably signal higher risk, and that large companies are often more resilient than they appear. Rather than fearing concentration, investors may be better served by understanding why it exists and by staying focused on long-term objectives rather than short-term discomfort. |

Monthly Market Commentary – December 2025

LOCAL DRIVERS

Central Bank Policy Paths Diverge

December highlighted increasing divergence across major central banks. The US Fed and the Bank of England cut rates, reflecting confidence that inflation pressures are easing and that restrictive policy is no longer required. In contrast, the European Central Bank held rates steady, signalling caution amid sticky services inflation and weak growth. Meanwhile, the Bank of Japan raised rates, marking another step away from ultra loose policy as domestic inflation and wage dynamics improve. This divergence has important implications for currency markets, global capital flows and relative asset valuations.

China: 2026 Policy Vision

China’s annual Central Economic Work Conference provided important signals on policy priorities for the year ahead. Authorities emphasised the need to stabilise growth, support domestic demand and address structural challenges in the property sector, while maintaining a cautious approach to large-scale stimulus. The focus on targeted fiscal support, technological self-sufficiency and financial stability suggests a preference for incremental rather than aggressive policy measures. Markets responded by reassessing China’s growth outlook and the potential spillover effects for emerging markets and global commodities.

SA GDP Growth

South Africa delivered a positive Q3 GDP surprise, with growth jumping to +2.1% y/y, up from a revised +0.9% y/y in Q2 2025 and beating Bloomberg’s+1.8% y/y consensus forecast. On a quarterly basis, the economy expanded +0.5% q/q, moderating from +0.9% q/q previously. Notably, nine out of ten industries recorded positive q/q growth. Electricity was the lone drag, contracting by -2.5% q/q as big industrial users of electricity have either scaled back operations or shut them down altogether due to the heavy price of electricity.

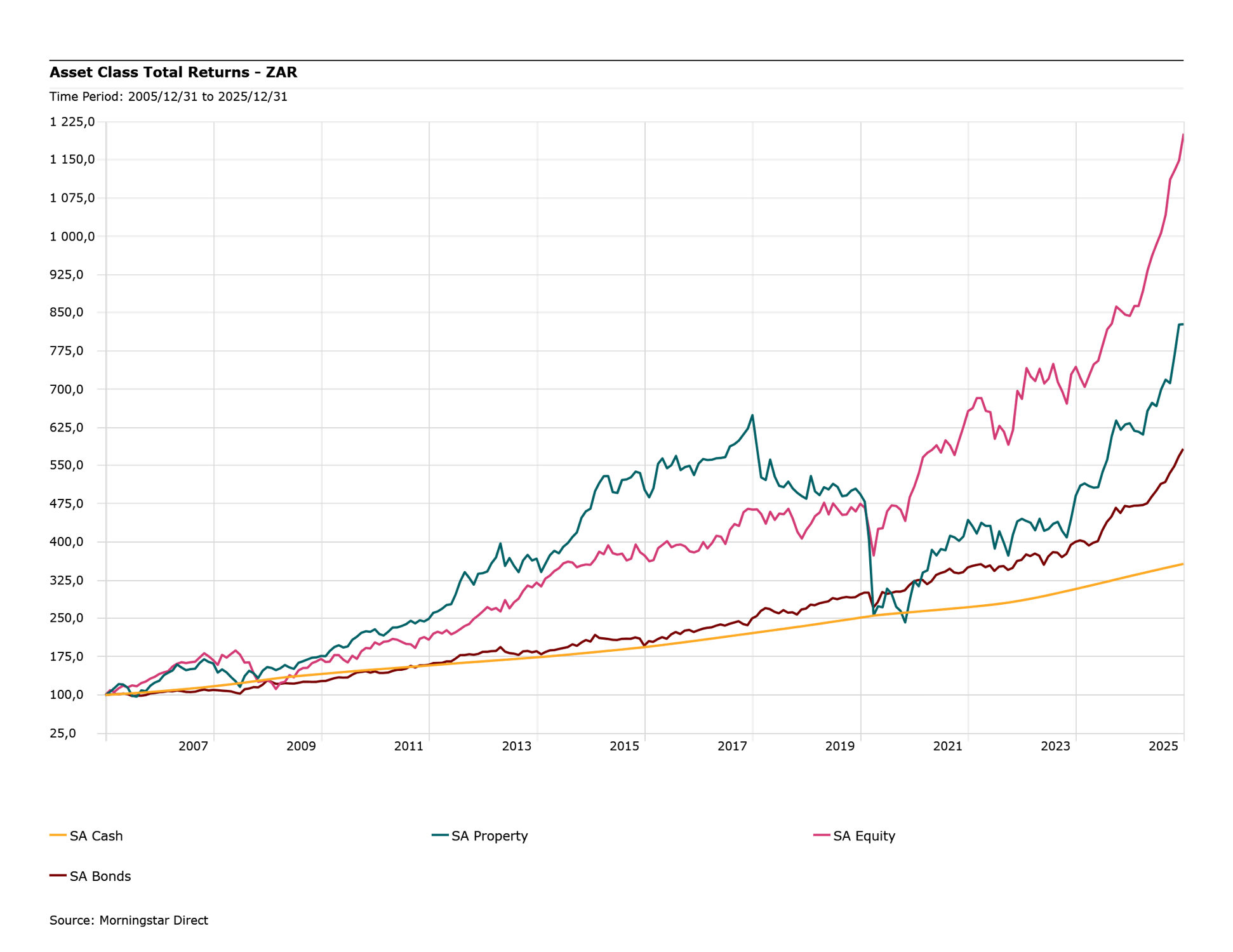

ASSET CLASS TOTAL RETURNS – ZAR

GLOBAL DRIVERS

Central Bank Policy Paths Diverge

December highlighted increasing divergence across major central banks. The US Fed and the Bank of England cut rates, reflecting confidence that inflation pressures are easing and that restrictive policy is no longer required. In contrast, the European Central Bank held rates steady, signalling caution amid sticky services inflation and weak growth. Meanwhile, the Bank of Japan raised rates, marking another step away from ultra-loose policy as domestic inflation and wage dynamics improve. This divergence has important implications for currency markets, global capital flows and relative asset valuations.

Sticky Inflation delaying Interest Rate Cuts

China’s annual Central Economic Work Conference provided important signals on policy priorities for the year ahead. Authorities emphasised the need to stabilise growth, support domestic demand and address structural challenges in the property sector, while maintaining a cautious approach to large-scale stimulus. The focus on targeted fiscal support, technological self-sufficiency and financial stability suggests a preference for incremental rather than aggressive policy measures. Markets responded by reassessing China’s growth outlook and the potential spillover effects for emerging markets and global commodities.

Heightened Geopolitical Tensions

Geopolitical risks remained elevated in December, with limited progress on diplomatic efforts around Ukraine and the uncertainty over future security arrangements. Tensions also rose after the US captured the Venezuelan president, increasing concerns around regional stability and potential energy market disruption. Meanwhile, discussions involving Greenland highlighted intensifying strategic competition among major powers, reinforcing a fragile global political backdrop.

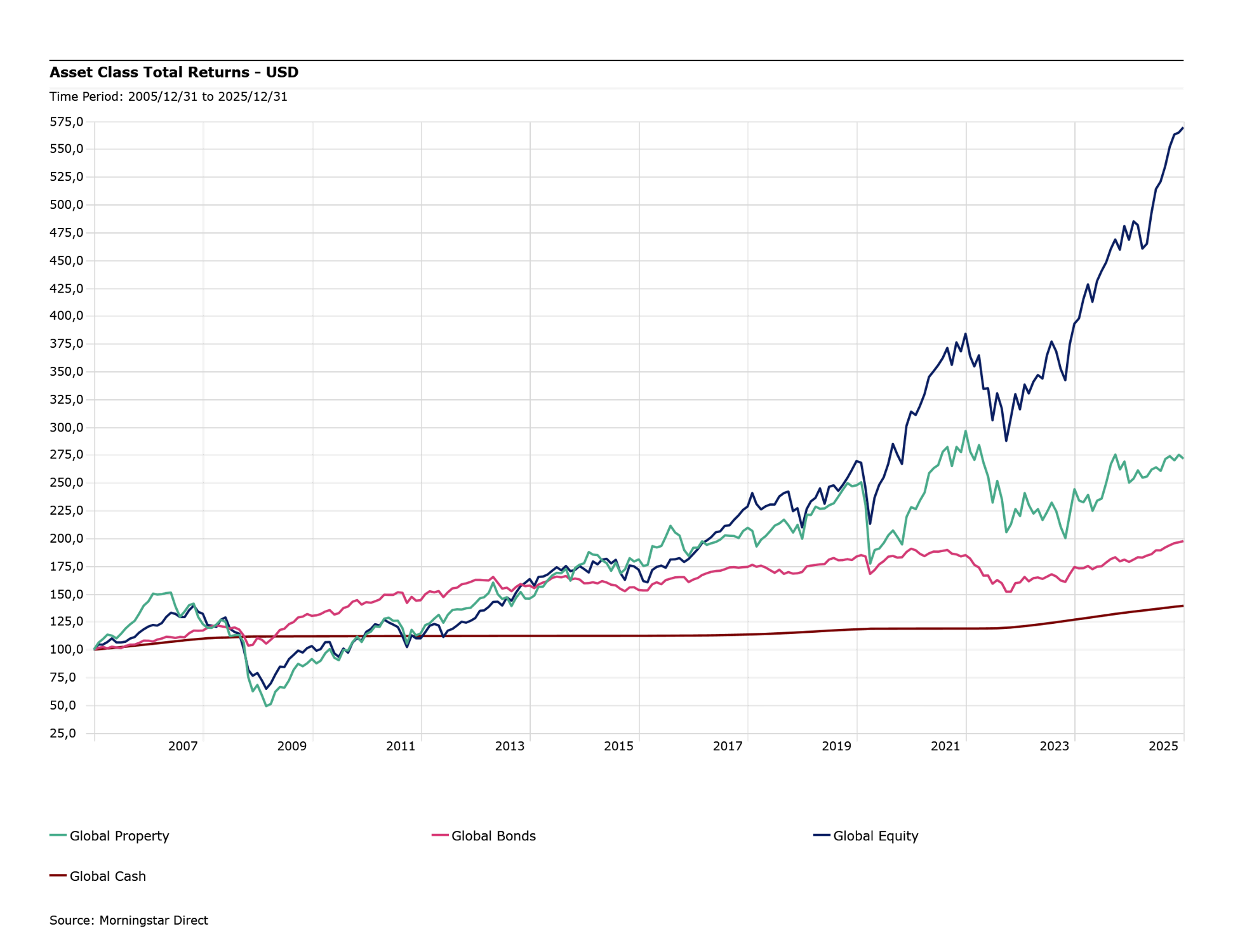

ASSET CLASS TOTAL RETURNS – USD

SHARE THIS ARTICLE