DeepSeek; A Lesson in Thematic Investing

January saw a major shake-up in the artificial intelligence (AI) investment landscape. A relatively unknown Chinese tech start-up, DeepSeek, announced the release of R1, an open reasoning large language model (LLM). The R1 model matches the performance of o1 (OpenAI’s frontier reasoning LLM) across math, coding and reasoning tasks, at a fraction of the cost while using inferior Nvidia chips.

DeepSeek claims R1 cost $5.6m to develop, paling in comparison to western developed models. The final training run for the latest Llama model from Meta was 10 times the cost, while just last year, Dario Amodei, the co-founder of leading AI firm Anthropic, put the cost of training advanced models at between $100m and $1bn.

Much of Nvidia’s recent meteoric rise had been built on the back of these high earnings expectations tied to AI development. However, the emergence of a competitor like DeepSeek has challenged this narrative. If AI models can be developed using more cost-effective alternatives, investors would need to relook at their assumptions around Nvidia’s long-term earnings growth prospects.

Marc Andreessen, a prominent US venture capitalist, likened the launch of the R1 model to a pivotal moment in the US-USSR space race. He described it as AI’s “Sputnik moment”, referring to the Soviet Union’s surprising achievement of launching a satellite into orbit during the Cold War.

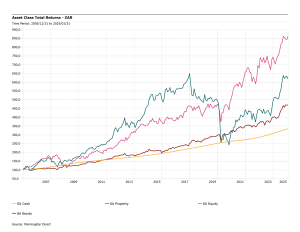

The market reaction was swift and unforgiving. Nvidia lost $589 billion of market capitalisation. This is larger than the individual market values of all but 13 US companies and is by far the largest single-day value wipeout of any company in history.

Figure 1: Biggest one-day drops in market capitalisation, $bn, for US companies

All That Glitters Is Not Gold

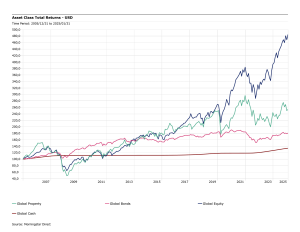

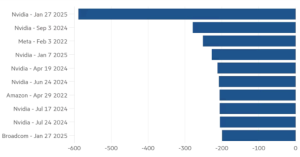

The rapid shift in the dynamics of the AI sector is a stark reminder of the dangers and heightened volatility while investing in trending themes of the moment. Thematic investing, while exciting, is often unpredictable. History is full of similar examples — from the dot-com boom to alternative energy, biotech funds, and more recently, artificial intelligence and big data.

According to Morningstar, assets in thematic funds have almost doubled in the last five years to June 2024, up from $269 billion to $562 billion, but down from their peak of $892 billion during the covid pandemic. Meanwhile, the number of live funds has more than doubled in those five years, with 2,776 options to choose from.

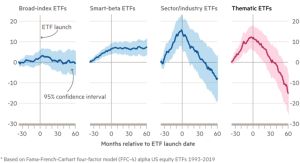

A study by the academics — Itzhak Ben-David, Rabih Moussawi, Francesco Franzoni and Byungwook Kim — suggest that the very worst time to buy thematic ETFs, is when they launch. That is principally because the funds tend to launch when the hype is at its peak, and just before performance declines. The full case study can be found here.

Figure 2: Cumulative risk-adjusted return of underlying indices (%)*

Research from Morningstar also shows that thematic investing is fraught with potential risks. Investors are, in effect, making a Trifecta bet; one where they must pick the right theme, the right fund provider to successfully implement that theme, and then getting the timing right. None of these three elements are easy, let alone getting all three right at the same time.

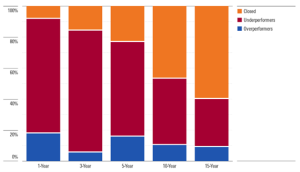

In fact, 60% of thematic funds launched in the last 15 years have shut down, and only 9% have both survived and outperformed a global equity benchmark.

Figure 3: Global Thematic Fund Survival and Success Rates vs. Global Equities

Recent market turbulence demonstrates this theme specific risk. AI-focused ETFs with large Nvidia and other AI-related stock exposures experienced significant declines. The ProShares Ultra Semiconductors ETF, with more than 40% of its assets in Nvidia, plunged over 24% in a single day. The Vanguard Information Technology Index Fund, where Nvidia represents nearly 15% of the portfolio, dropped 5.25%. Meanwhile, the VistaShares Artificial Intelligence Supercycle ETF, with a more diversified AI stock portfolio but 3% exposure to Nvidia, saw losses of about 10%. These sharp declines highlight the vulnerability of thematic investments to sudden market shifts.

At PortfolioMetrix, we avoid chasing trends. Instead, we aim to build resilient, well diversified portfolios designed to withstand market shifts, ensuring clients stay focused on long-term success rather than short-term speculation. Our approach enables us to protect and grow wealth according to each investor’s risk profile, irrespective of what the latest market fad is.