The start of the new year saw a moderation in the exuberance that characterized the end of 2023. Markets, which had leaned heavily towards anticipating rapid central bank rate cuts in 2024 at the close of the previous year, shifted towards the expectation of later rate cuts. January brought positive economic data, especially in the US, coupled with slightly higher-than-expected inflation figures. Central banks’ communication playing down the chances of a Q1 interest rate cut was slightly negative for bonds, causing yields to rise and prices to fall. The equity market response was mixed but generally positive for developed markets. Lingering weak sentiment in China continued to weigh on emerging markets. Tensions in the Middle East led to a slight increase in energy prices.

Monthly Market Commentary – January 2024

LOCAL DRIVERS

SA Inflation

SA inflation came in lower for the second consecutive month at 5.1% (YoY, December). This is positive considering that the SA Reserve Bank is running a real policy rate of 3.1%, something that can be lowered upon inflation reaching the middle of the target band (4.5%) and easing in the US. The SARB MPC maintained rates at 8.25%.

SA Trade Surplus

A trade surplus of R14bn was recorded in December 2023 bringing the full-year trade surplus for 2023 to R61bn (2022: R192bn). It is expected for this to continue to deteriorate as we see broad-based weakness in imports and exports.

Private Sector Credit Growth Rise

There was an unexpected increase in private sector credit growth in December 2023 to 4.9% year-on-year. It was pushed higher by an increase in corporate credit. Slowing consumer credit dampened the figure somewhat with growth in mortgage lending, in particular, struggling due to the high interest rate environment.

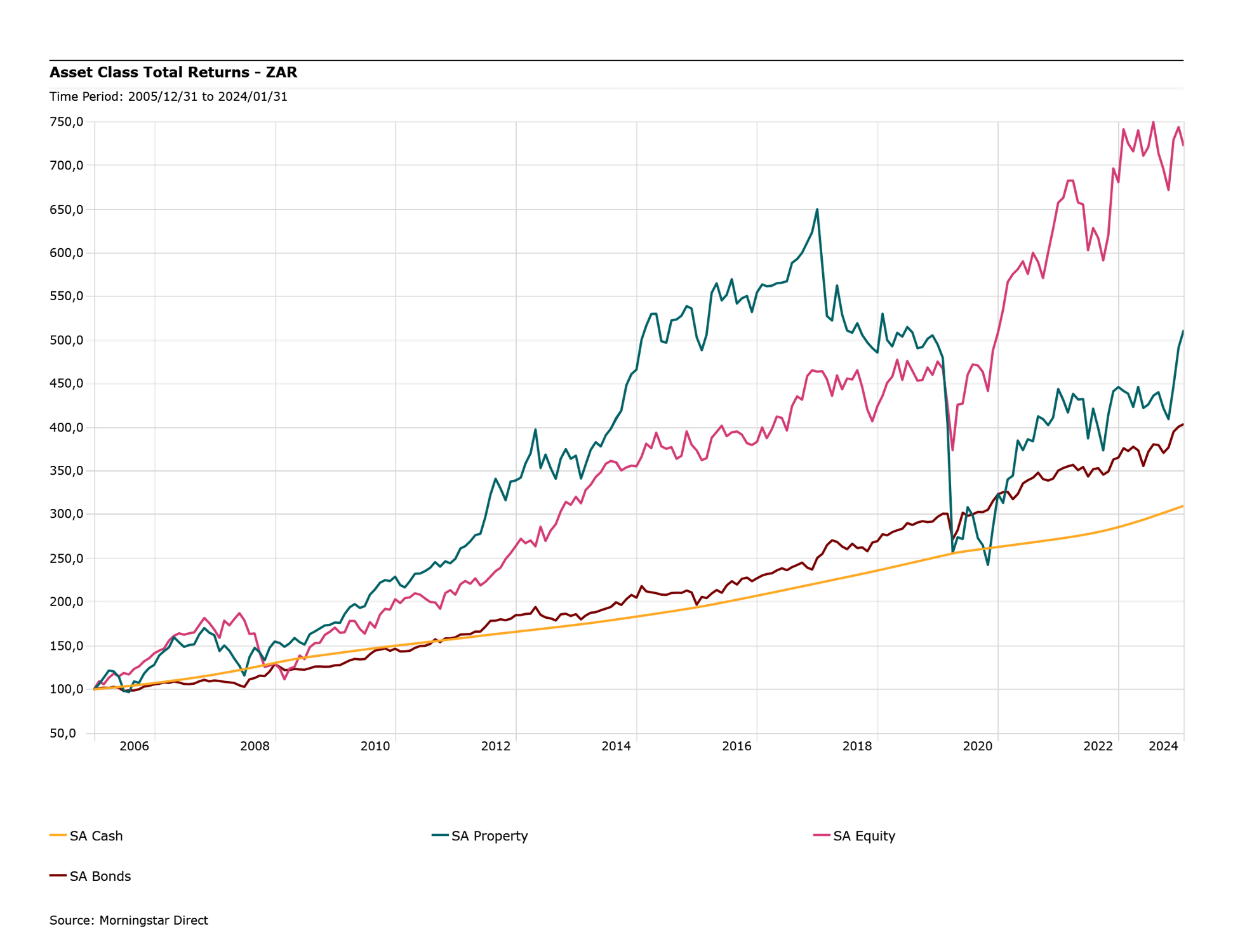

ASSET CLASS TOTAL RETURNS – ZAR

GLOBAL DRIVERS

US Economic Resilience

Markets were treated to a barrage of surprisingly resilient economic data from the largest economy in the world. Firstly, the Q4 annualised quarter-on-quarter GDP growth figure was recorded as 3.3%, significantly above the 2% expected rise, aided by strength in exports. Businesses also appeared to be optimistic as Composite PMI stood at 52 in January, an increase from 50.9 the month before. This was driven by strong activity in both services and manufacturing. Households were not left out from the positive sentiment as 216,000 new jobs were created in December, above the 170,000 expected

US Inflation and Rates

Headline inflation rose to 3.4% in December, from 3.1% the prior month and above expectations of 3.2%. The Federal Open Markets Committee agreed to keep interest rates unchanged on the last day of the month and their accompanying communication almost certainly ruled out a cut in March. This and the inflation increase led to a reassessment of the likely speed of future interest rate cuts, with markets now pricing in only 1.5% of rate cuts this year (vs 2% at the start of January).

Euro Area Struggles

The euro area economic data continued to be largely disappointing in January. Bigger picture, Q4 GDP growth showed stagnation at 0% which, if confirmed in the final figure, would mean that the bloc narrowly avoided going into a recession (having fallen 0.1% in Q3). Composite PMI data reflected this weakness, with January showing a slight pick-up to 47.9, from 47.6 in December, but still well below the 50 neutral threshold.

ASSET CLASS TOTAL RETURNS – USD

All information provided courtesy of Portfolio Metrix – adapted and published with permission. No copyright infringement intended.

SHARE THIS ARTICLE