Global Market Overview

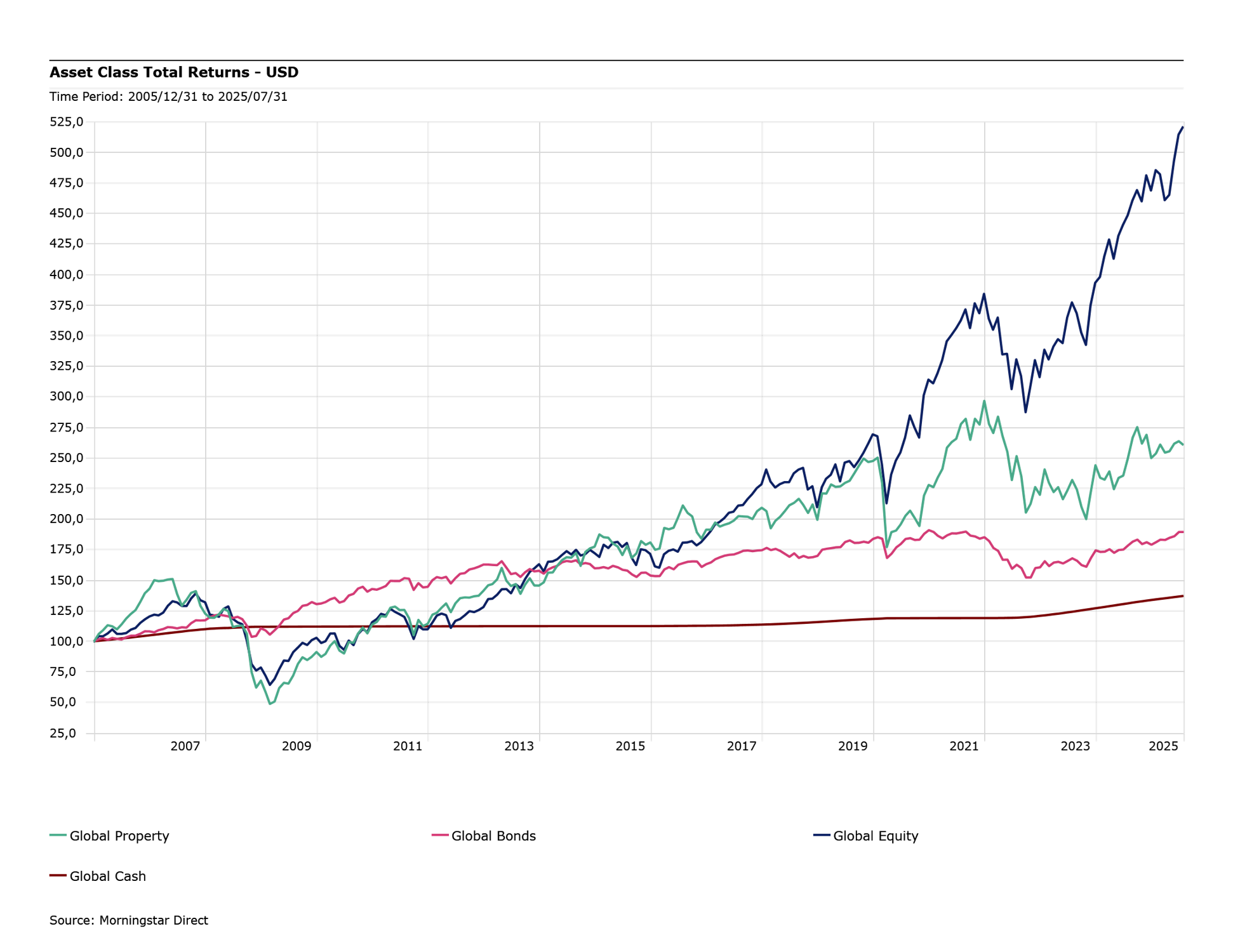

Global markets continued to build on their mid-year momentum in July, buoyed by easing inflationary concerns, resilient corporate earnings, and improved risk appetite across developed and emerging markets. US equity markets delivered another solid month, with the S&P 500 climbing 2.22% in USD and the Nasdaq 100 advancing 2.40%, supported by ongoing strength in technology and AI-linked counters. Year-to-date, these indices are up 8.34% and 10.82%, respectively. This bullish sentiment prevailed despite the Federal Reserve opting to hold rates steady at 4.5%, resisting mounting political pressure from the Trump administration to ease monetary policy in light of tepid service sector growth and softer private sector hiring.

Economic data out of the US remained mixed. Second-quarter GDP came in above expectations, but payroll growth slowed, with only 74,000 private sector jobs added in June. Inflation re-accelerated slightly, with the PCE deflator and CPI both ticking up to 2.6% and 2.7% year-on-year, respectively. However, forward-looking indicators such as consumer confidence and the Conference Board’s Expectations Index improved, suggesting a more optimistic outlook heading into the second half of the year.

In Europe, equity markets also registered gains, led by the FTSE 100, which returned 0.74% in USD terms for the month and 20.69% YTD. The ECB paused rate cuts in July, maintaining the policy rate at 2%, while negotiations over new transatlantic trade agreements continued to weigh on investor sentiment. Inflation across the Eurozone held steady at the 2% target, although services inflation remained sticky.

China was a standout in emerging markets once again. The Hang Seng Index gained 3.09% in July, bringing its YTD return to 25.19% in USD, driven by improving economic data and strong export growth to ASEAN countries. Chinese GDP expanded by 5.2% in the second quarter, outpacing expectations, while exports rose by 5.8% year-on-year in June. However, weakness in manufacturing PMI, which slipped to 49.3, highlighted the ongoing drag from elevated US tariffs. Japan’s Nikkei retreated by 1.73% in USD, despite improved business sentiment and a stronger services sector, as the Yen weakened and concerns about slowing exports re-emerged.

Commodities were mixed. Brent Crude surged 13% during the month on supply constraints and rising demand, while precious metals held firm as geopolitical risks underpinned safe-haven demand. Industrial metals, particularly copper, were volatile due to tariff concerns, but gold consolidated recent gains with ongoing Central Bank purchases.

The MSCI Emerging Markets Index rose 1.95% in USD for the month and is up 17.51% year-to-date, outperforming developed markets (MSCI World +1.29% for July, +10.88% YTD). The Dollar weakened modestly, adding to EM momentum.

South African Market Overview

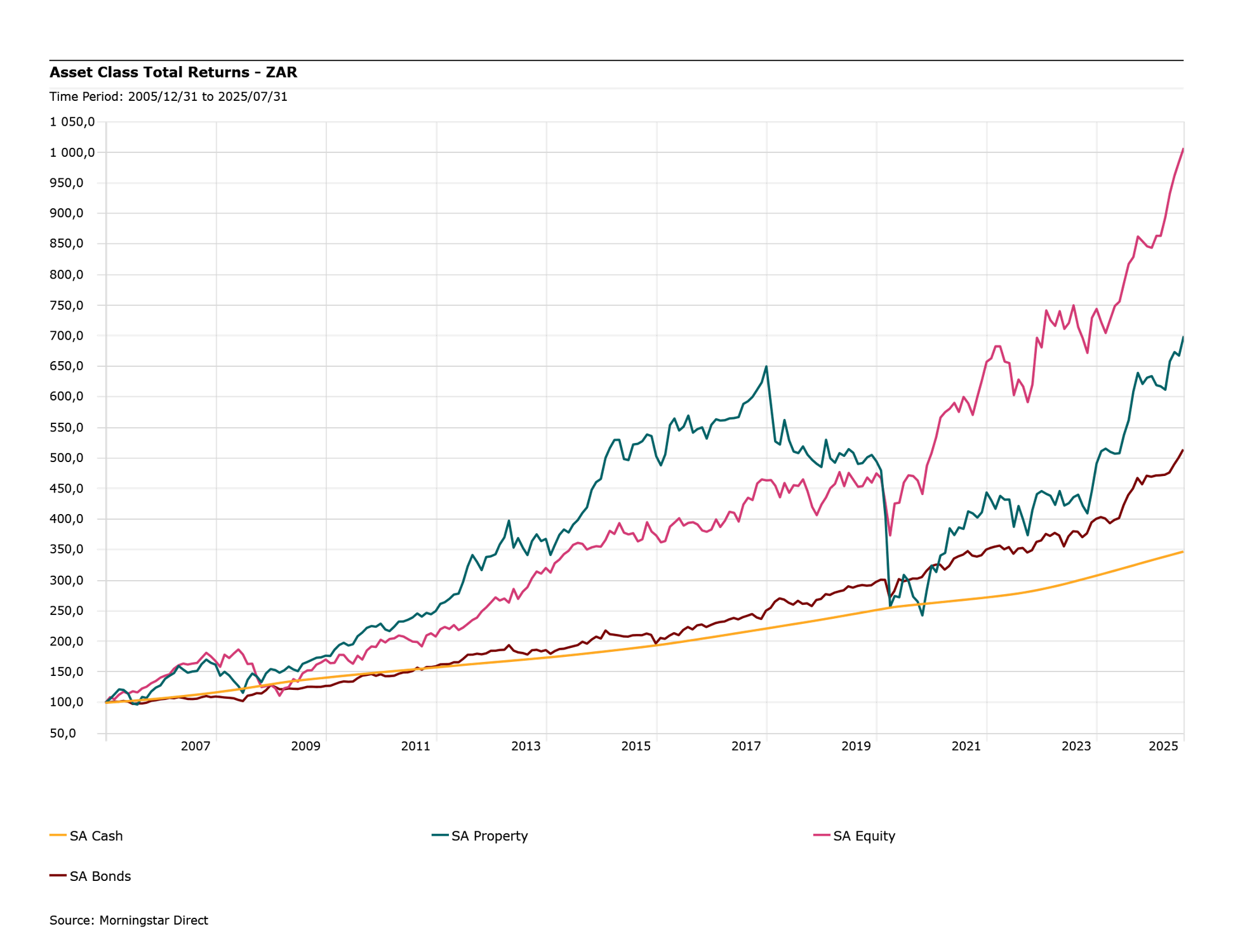

On the local front, South African assets performed strongly in July, aided by positive global sentiment and a dovish shift from the South African Reserve Bank. The FTSE/JSE All Share Index rose by 2.27% in ZAR terms, with a robust 19.35% YTD gain. SA Listed Property delivered a return of 4.75% in July, while All Bonds returned 2.73%, both benefitting from lower inflation and rate expectations. The Rand was relatively stable, ending the month at R18.22/USD.

The SARB delivered a well-telegraphed but impactful 25bps rate cut, lowering the repo rate to 7.00% in a unanimous MPC decision. The Central Bank also signalled a shift in its inflation-targeting approach, indicating a preference to guide inflation toward the lower end of the 3–6% band, closer to 3%. This was interpreted by markets as a signal of future easing bias, particularly as headline CPI remained anchored at 3% and core inflation softened to 2.9%.

South Africa’s economic data was subdued but showed early signs of stabilisation. Manufacturing production posted a 0.5% year-on-year increase in May—the first positive figure in over six months—driven by metals and machinery. Mining output rose a modest 0.2%, with precious metals offering some support. However, ongoing US tariffs on SA exports, especially in automotive and agriculture, continued to cast a shadow over forward-looking growth indicators.

From a sectoral perspective, July saw significant outperformance from resource-heavy counters. Sasol led the pack with an 18.99% gain on the back of operational improvements, Transnet settlements, and further investment into renewable energy projects. Sibanye Stillwater also gained 18.94%, boosted by its petition to US trade authorities to curb Russian palladium dumping. Meanwhile, heavyweights like British American Tobacco and Northam Platinum added to the strength. Conversely, consumer-focused stocks such as Mondi (-14.76%), Anheuser-Busch InBev (-12.39%), and Richemont (-10.58%) struggled on weaker earnings and external pressures.

South African bonds rallied as yields compressed following the SARB’s rate decision and dovish guidance. The bond market also responded favourably to subdued inflation and slightly improved fiscal metrics.