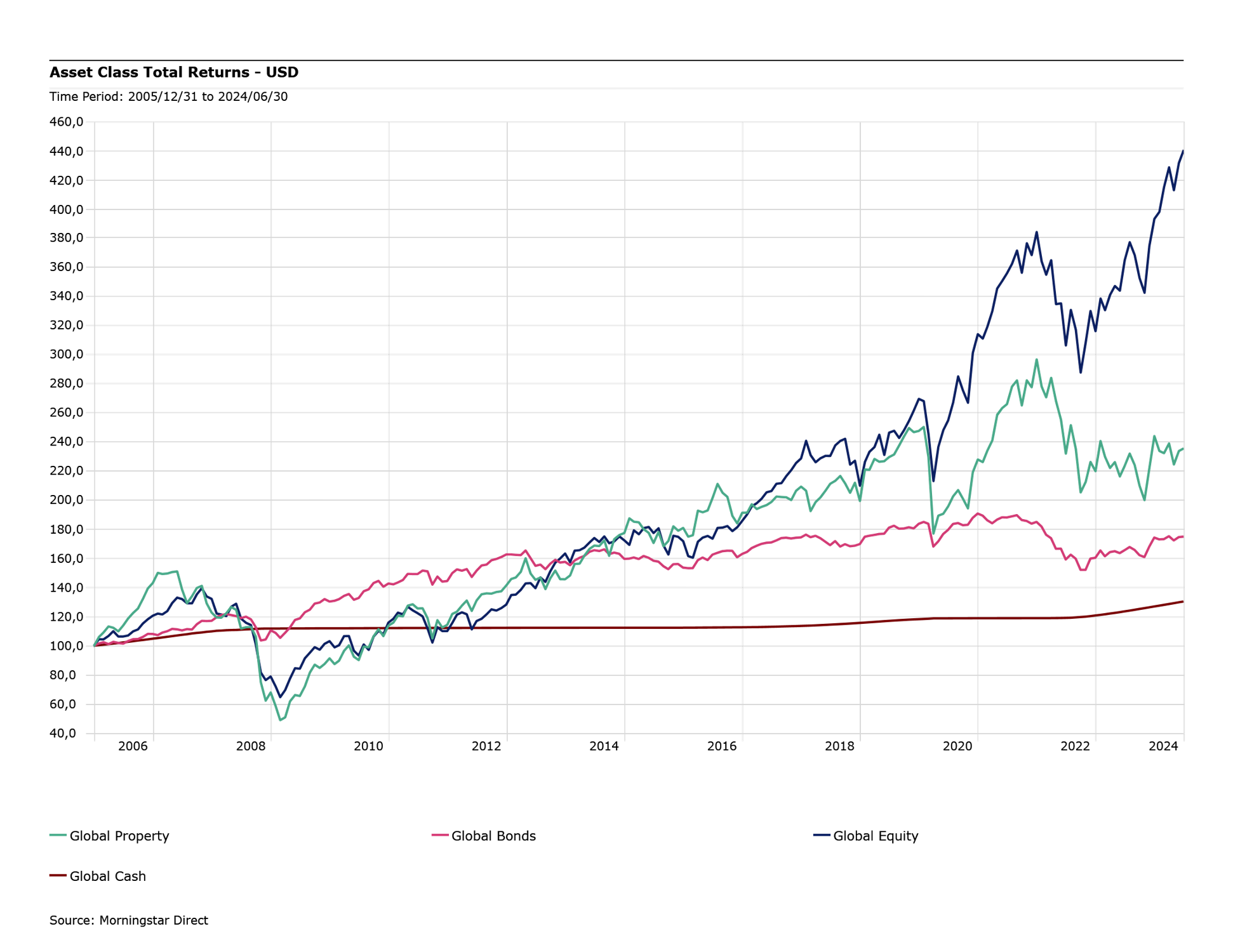

June saw mixed results across markets, with varying returns in both bond markets and equity regions. Generally, bond yields fell slightly, supporting fixed income prices, as inflation moderated across most regions, most notably in the UK where inflation dropped to the Bank of England’s target of 2.0% for the first time since 2021. The European Central Bank (ECB) cut interest rates as expected, however the timing of the first rate cut from the Bank of England and US Federal Reserve remain uncertain – although markets still expect them to occur this year. UK and European equities fell, as a surprise snap general election was called in France – causing some uncertainty in European markets. US equities performed strongly as did emerging market equities following the results of the Indian general election and Chinese data that again surprised to the upside.

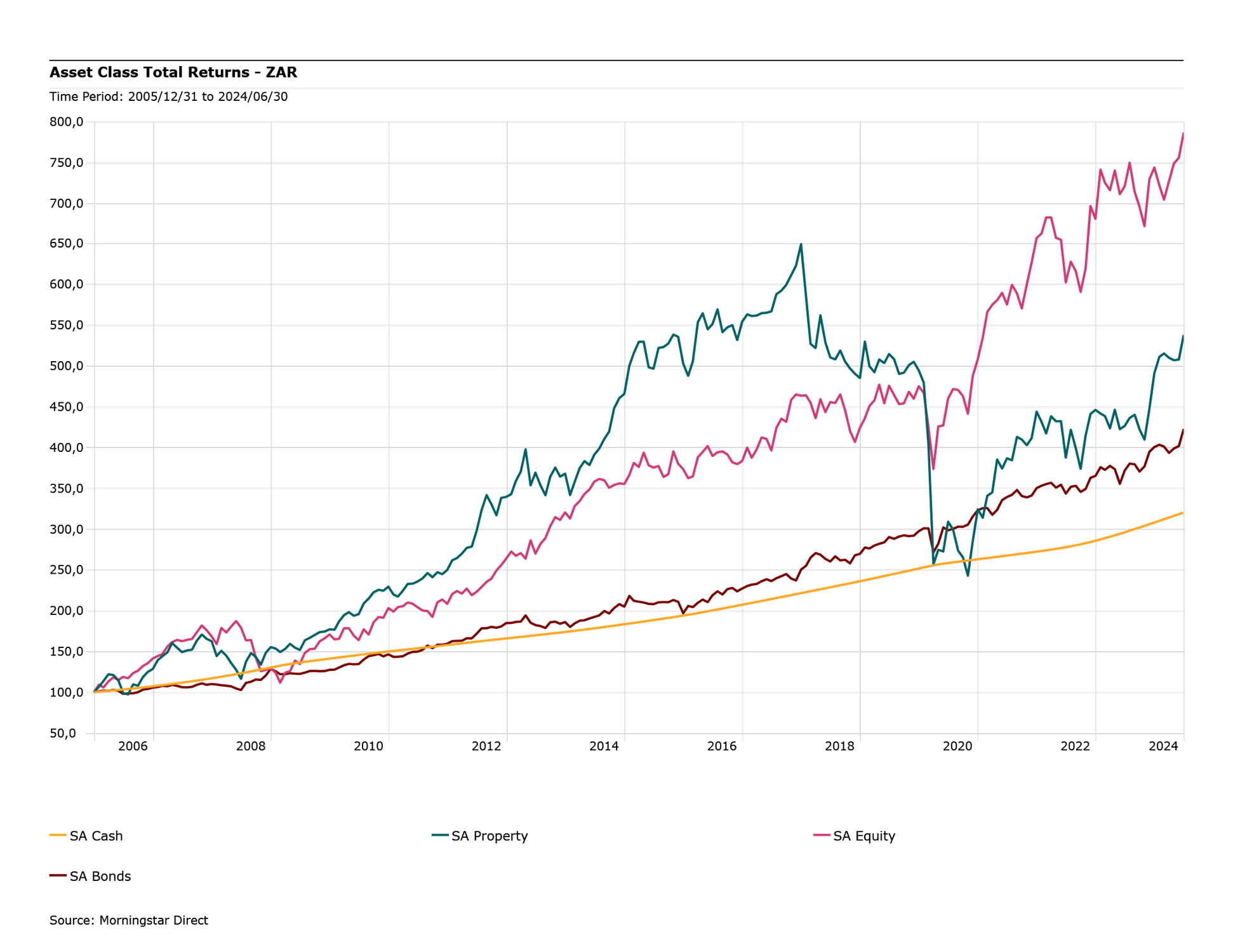

It was an exceptionally favorable month for South African asset classes, marked by the strengthening of the rand, a rally in bond yields, and strong performance in local equities, particularly in financials and property stocks. This was driven by optimism from election results whereby the ANC lost its majority, and a government of national unity was formed. The local market was one of the top performing emerging markets over the month meaningfully outperforming the broader EM indices which in turn outperformed developed markets. Due to a stronger rand, global asset classes underperformed despite reasonable returns in hard currency.