Inflation in the US continues on its downward trend, just at a slower pace than originally anticipated by the markets. This has led the US Fed to maintain rates at a higher level. Other central bankers however face slightly different challenges and as such have begun cutting rates in their economies. Despite the higher US rates and increased geopolitical risks markets continue to reward the A.I.-themed rally benefitting the mega-cap US tech stocks such as NVIDIA and Microsoft. Global equities led returns in this environment.

Elsewhere, Chinese optimism has lifted ever so slightly in the midst of a confidence crisis and the UK heats up as they enter the runup to their elections in July. The Labour party lead the Conservative party in the polls.

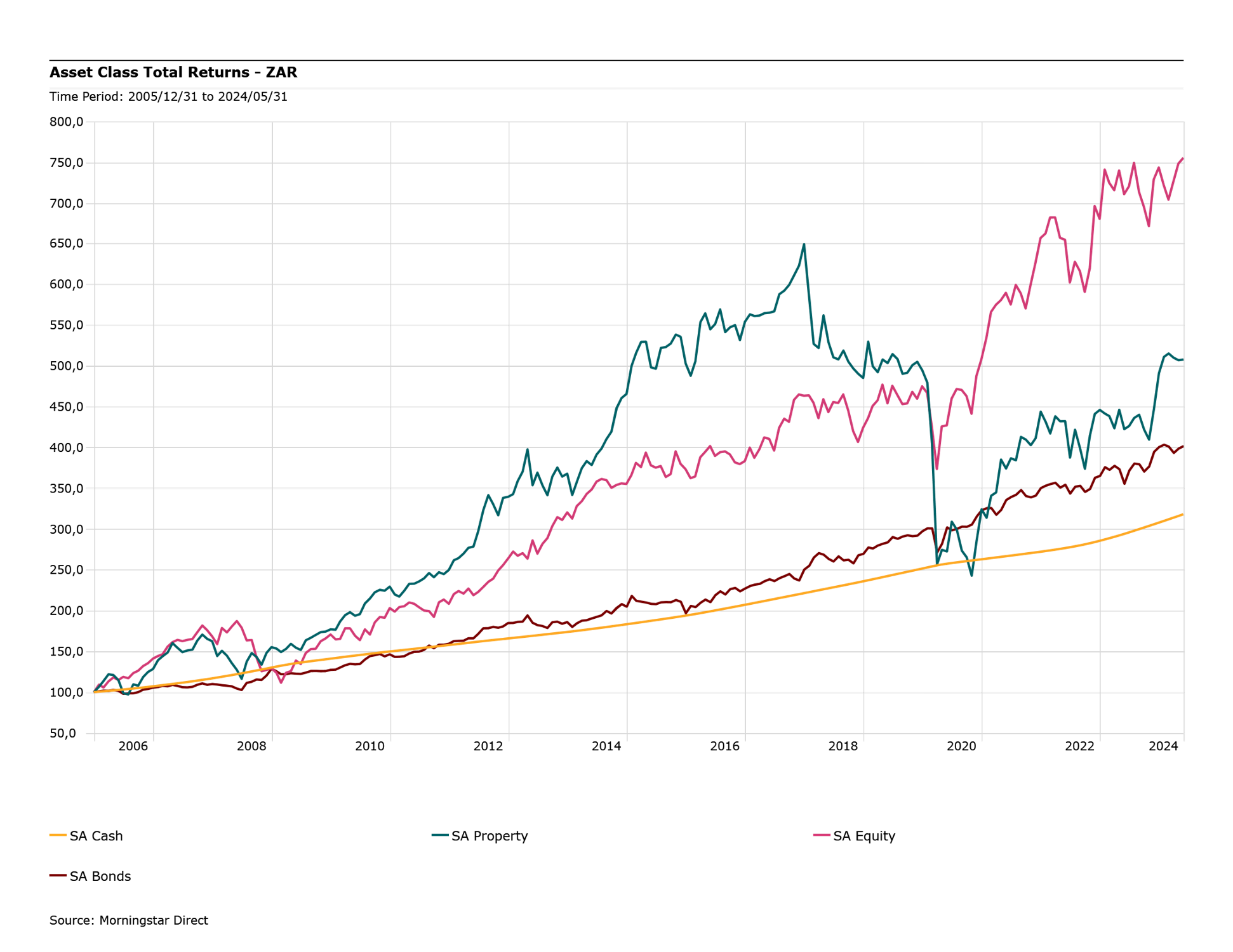

South African (SA) asset classes had a very muted response during May, choosing a holding pattern after a very strong leadup into the election month. Uncertainty prevailed as the ANC has evidently lost its 30-year majority rule. What is important to recognize is that the elections appear to have been free and fair, and whilst turnout of all eligible voters has been quite low we have observed a peaceful democratic process. All eyes now turn to the coalition phase of our democracy, a very important tone will be set by which parties form coalitions at both national and provincial levels. Given the cheaper valuations of South African asset classes we remain optimistic of good forward returns should some uncertainty settle.