How good is your forecast?

Cast your mind back to this time last year. How many confident “2025 Outlook” pieces did you read or listen to? And now, ask yourself: how many of those forecasts actually played out?

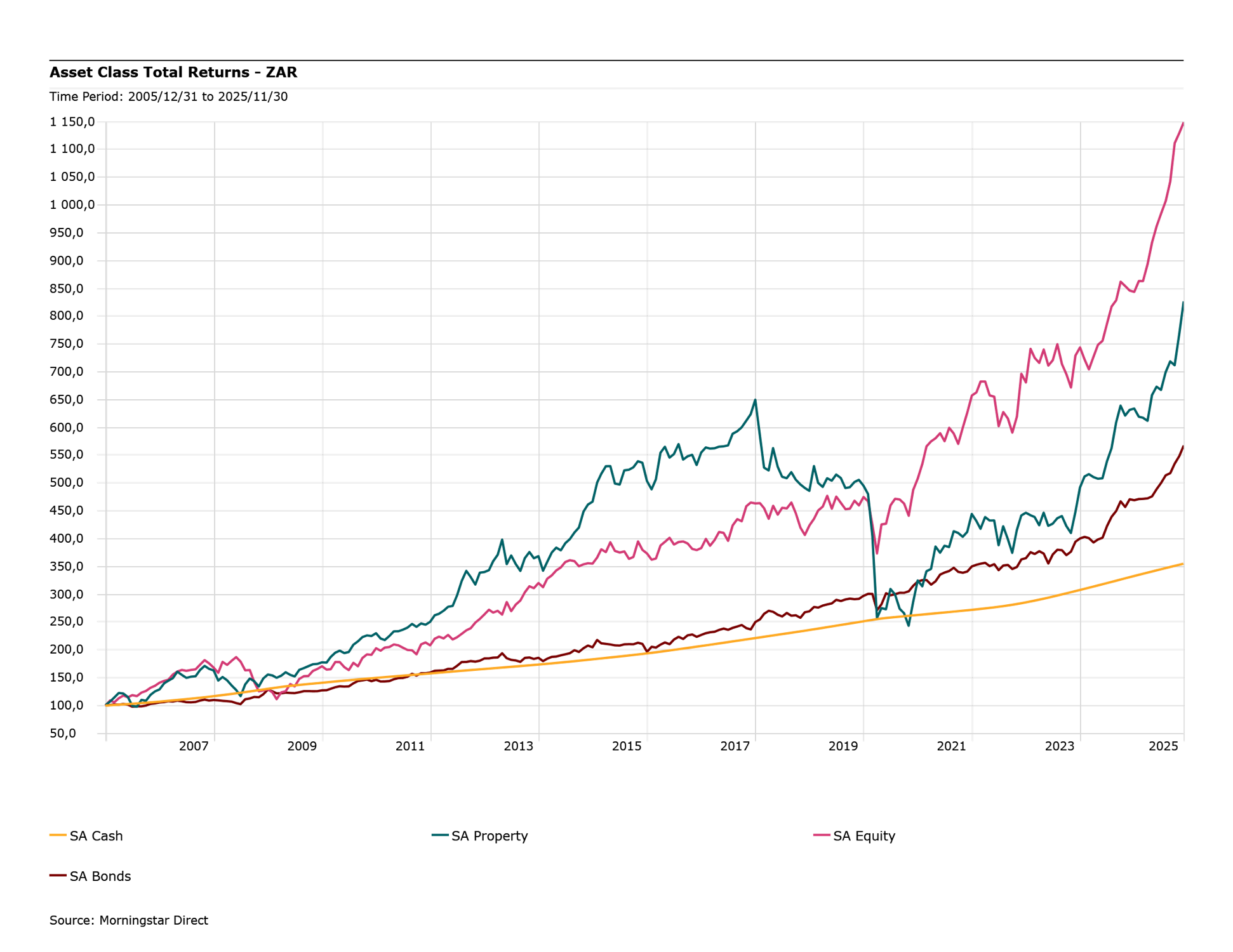

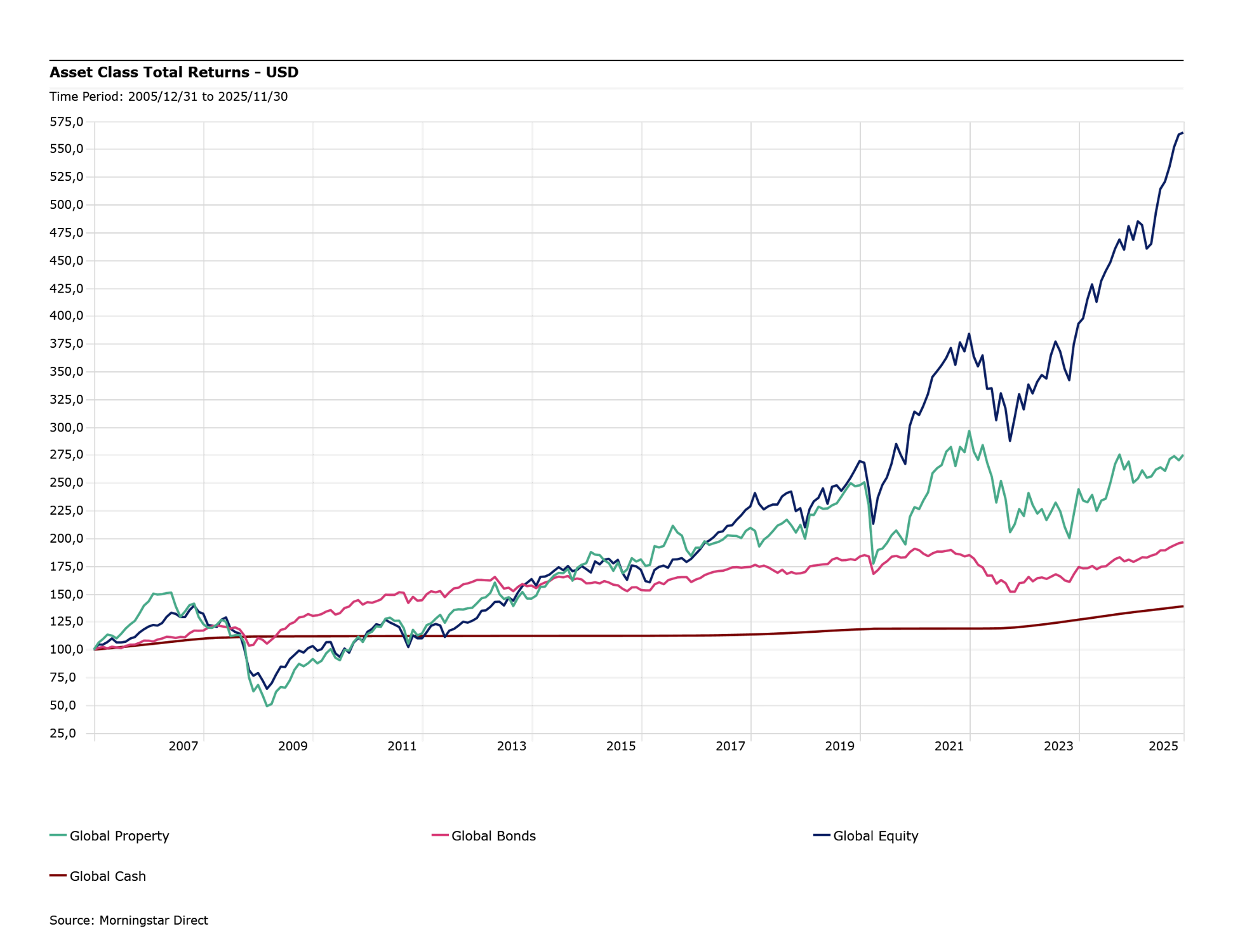

We began the year with talk of a tariff driven recession, rapid interest rate cuts and the end of US dollar dominance. Instead, growth has slowed but not collapsed, interest rates have stayed higher for longer, and after weakening early in the year, the US dollar has strengthened again in the second half of 2025.

So as the next wave of forecasts start to land in your inbox, it is worth asking: how much weight should investors really give to these calls?

Reality check: 2025 forecasts vs 2025 experienced

Global growth is a good starting point. Early in the year, economists warned that new trade tariffs could push the world close to recession, and leave the United States facing stagflation – weak growth and stubborn inflation. Instead, recent updates show the tariff hit has been smaller than feared and growth has slowed but stayed positive, helped by new trade deals and companies working around disruptions. The worst case headlines have not materialised, at least so far.

Linked to global growth, many investors expected rapid and repeated cuts from major central banks throughout the year. Instead, the Federal Reserve, the Bank of England and the European Central Bank have mostly stayed on hold, signaling they may cut later and less than markets once hoped. Perhaps this shouldn’t surprise us given how poorly the market has historically forecast the future path of interest rates.

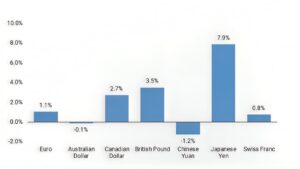

Finally, early-year weakness in the US Dollar initially seemed to support the narrative of waning US dollar dominance. However, in response to slower-than-expected Fed rate cuts, a stronger-than-anticipated US economy, and resurfacing global risks, the US dollar has strengthened against most major currencies over the second half of the year.

USD Performance Relative to Major Currencies (Positive = USD Stronger)

June 2025 to December 2025

Source: Morningstar. Past Performance is not a reliable indicator of future performance

Short-term market behaviour also depends heavily on events that forecasts don’t model well such as investor flows, changes in sentiment, policy signals, and general market narrative.

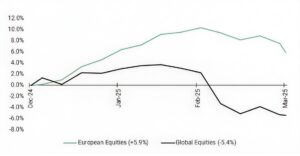

For example, at the start of 2025, the consensus view for European equities in 2025 focused on weak growth, fading consumer momentum and political fragmentation. Yet, Europe rallied strongly in Q1 as new information emerged around supportive fiscal policy, ECB rate cuts, and stabilising economic growth. This information was unknown at the time of writing 2025 Outlook pieces, but drove positive sentiment in the first quarter of 2025.

Performance of European Equities vs Global Equities: Q1 2025

Source: Morningstar. Currency Euros. Past performance is not a reliable indicator of future performance

So why do we love forecasts?

People naturally dislike uncertainty – not least when it concerns their savings and investments. Statements such as “We think markets will do X because…” offer reassurance by turning a messy, uncertain future into a neat story. They create the impression of control and give asset management firms a reason to issue glossy reports, host webinars and give media soundbites. Ultimately, it all fits how our brains work and how the industry markets itself.

There is nothing wrong with thinking about the future – in fact, it is essential for financial planning. The problem comes, when short term forecasts are treated as reliable instructions rather than educated guesses, and financial plans are built on those guesses being correct.

In the end, the pressure to predict and the storytelling that follows pulls investor attention in the wrong direction. It encourages a focus on short term narratives, rather than the quieter work that actually drives client outcomes.

If not forecasting, where should you focus your attention?

In our view, the real value in investment management rarely comes from bold one-year calls. Instead, it comes from three quieter, more reliable disciplines.

- Building Portfolios Aligned to Client Goals. This requires aligning portfolios to the appropriate risk level, time horizon and other preferences such as active/passive split or sustainability considerations, rather than chasing the latest big picture economic story.

- Diversifying Effectively. Being mindful of the investment opportunity set and spreading money across different kinds of investments ensures that no single company, sector or region can make or break the outcome. Diversification cannot remove all losses, but it can reduce the chance that one shock derails the plan.

- Helping Clients Stay Invested. Behaviour matters more than any forecast and it is common to want to bail out after falls or to pile into whatever has just done well. A well-constructed resilient portfolio makes it easier for advisers to keep clients anchored to their long-term plan – especially when headlines are loudest.

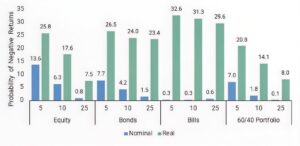

The below chart illustrates these points well. Firstly, with reference to diversification. A well diversified 60/40 portfolio has historically displayed a lower probability of loss over all time periods analysed. compared to the individual assets that are used to construct the portfolio. And secondly, with reference to time horizon, across all asset classes analysed, the longer the time horizon, the lower the historical probability of negative returns has been.

Probability of Negative Total Returns (nominal and real) over 5, 10 and 25 year Horizons across all sample economies and periods using 200 years plus of data across 56 countries

Source: Finaeon, Bloomberg Finance LP, Haver Analytics, Deutsche Bank. Note: availability of data varies across asset classes and types of returns. Past performance is not a reliable indicator of future performance

How we think about forecasts

We pay close attention to what is happening in economies and markets, but we do not build our portfolios on forecasts of the expected path of growth, inflation or interest rates over the next year.

Instead, we build diversified portfolios that are designed to cope with a range of environments. We consider how different assets have tended to behave in different conditions, we check how portfolios might respond under stress, and we rebalance when markets move sharply so that total portfolio risk does not quietly drift away from the agreed level.

The aim is robustness. Portfolios should not stand or fall on any single story about what may happen next.

How clients can use forecasts more wisely

Forecasts are not going away, and some can be useful context. The key is how you respond to them.

- Treat forecasts as possibilities, not promises

- Ask what happens if they are wrong as well as if they are right

- Consider who is making the call and why

Above all, attention should match the time horizon. For most investors, the long term is far more important than any 12-month market prediction. The real drivers of success are saving at the right level, holding an appropriate mix of investments and staying invested through the inevitable bumps.

As we enter another outlook season, that is the message we would emphasize. You do not need a perfect forecast to reach your goals, but you do need a clear plan, a resilient portfolio and the discipline to stick with it when the headlines pull in other directions.