It’s been a turbulent time in markets over the last few weeks, with both bonds and equities falling in October. At the beginning of the month, Hamas militants launched a surprise attack on Israel, which drew out a strong response from Israeli defence forces. The Israeli Prime Minister, Benjamin Netanyahu, referred to the attack as an act of war. This had an impact on financial markets as uncertainty rose, bringing about volatility as well as a temporary rise in oil prices around concerns the conflict could widen to larger oil-exporting nations. Elsewhere, in a similar fashion to September, broadly stronger economic news in the US translated into weaker financial market performance globally. The strong growth and employment data releases reinforced market participants’ view of interest rates being higher for longer. This caused bond yields to rise slightly (and hence bond prices to fall) as well as depressing equity markets.

Monthly Market Commentary – October 2023

LOCAL DRIVERS

SA Inflation

The local inflation rate rose to a three-month high of 5.4% in September from 4.8% in August on the back of higher food and energy prices. The stubbornness of inflation locally and globally leaves risks to the upside, and the likelihood of the SARB maintaining borrowing costs higher for longer.

Medium-Term Budget Policy Statement

SA bonds had a surprisingly strong month ahead of such an important update as the MTBPS. The numbers did not look good, but it would appear that the Finance Minister’s realism and his willingness to push back against his critics have investors optimistic that he has enough political capital to push through certain policy reforms. With so much bad news priced in, SA has enjoyed a relief rally despite deteriorating fiscal metrics. Local yields were no doubt supported by a late rally in US yields and additional stimulus from China.

IMF Raises Growth Forecasts

The IMF raised its growth projections for South Africa for 2023 and 2024 to 0.9% and 1.8%, respectively. The international body generally expects developing economies to fare better than developed markets due to lower debt ratios. More specifically, the IMF raised forecasts on better energy accessibility in the country, a large drag on growth in SA. That said, growth in SA is expected to lag that of Sub-Saharan Africa due to energy and logistical constraints and other broader structural issues.

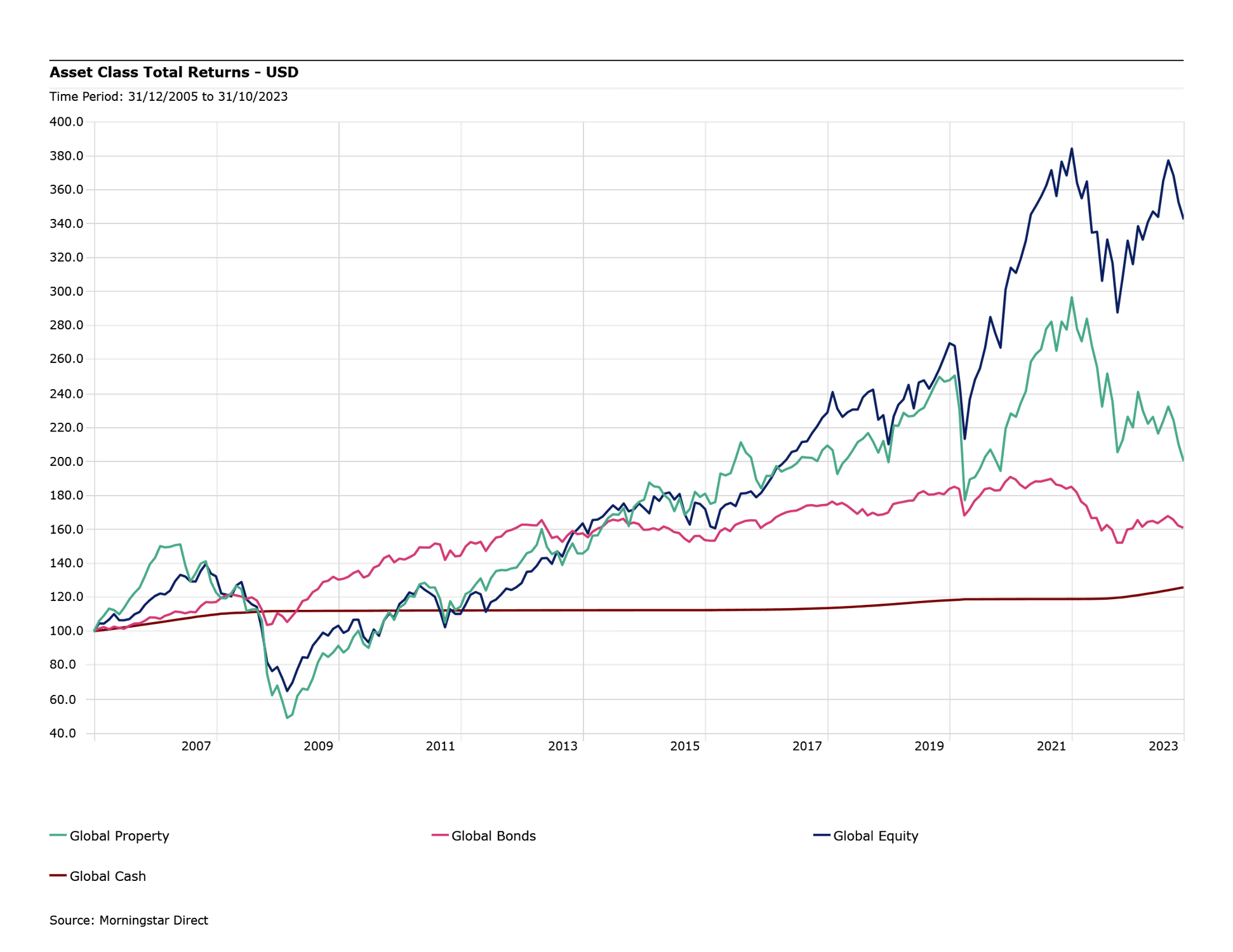

ASSET CLASS TOTAL RETURNS – ZAR

GLOBAL DRIVERS

Middle East Conflict

The events unfolding in the Middle East are a tragedy for civilian Israelis and Palestinians alike, both of whom have suffered heavy casualties. From a human perspective, a resolution of the crisis is to be dearly wished for. Markets also wish for an end to the crisis given the risks involved, but as of yet, they have only been mildly affected. Gold, which tends to rise with increased geopolitical risk, was up about 7% over October. Israel and its neighbours are not big economies globally, so there’s not any direct economic fallout on their economies that worries markets. Rather, as always with the Middle East, the worries centre around oil, of which Israel’s neighbours (and particularly Saudi Arabia) are particularly big exporters. In the back of traders’ minds is always the 1973 Arab-Israeli War and subsequent Arab oil embargo, which led to high inflation and economic strain on the US as well as other oil importers, the archetype of “stagflation”. Interestingly, while oil did indeed tick higher within the month, from $81 to $88 for WTI Crude, it then returned to $81 by the end of the month. Markets, at least, believe the risks of escalation remain low.

US Economy Outperforms

The first reading for Q3 GDP was an annualised growth of 4.9%, above expectations of 4.3%. This was complemented with a flurry of other positive economic data, including positive PMI numbers, better job data, and moderating inflation. Unfortunately, market participants continued to view these positive data as supporting the Federal Reserve keeping rates higher for longer, which impacted both bond and equity performance negatively.

Europe Slows

Things were not so rosy in Europe, as the initial figure for Q3 quarter-on-quarter GDP growth was a 0.1% contraction, the weakest reading since Q4 2021 and undershooting the expectation of a flatlining economy. Positively, however, inflation also fell from 4.3% to 2.9%

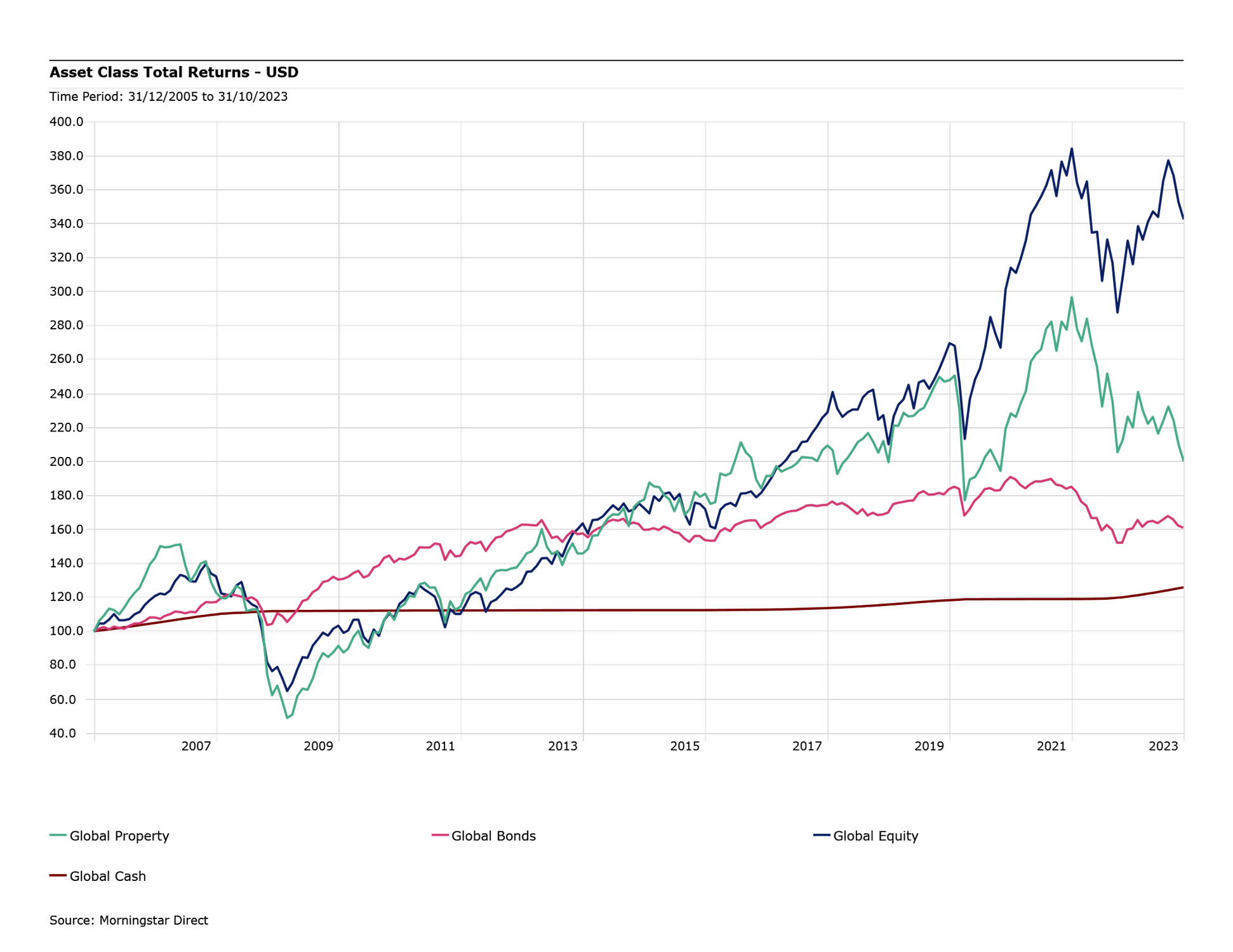

ASSET CLASS TOTAL RETURNS – USD

All information provided courtesy of Portfolio Metrix – adapted and published with permission. No copyright infringement intended.

SHARE THIS ARTICLE