Understanding gold in portfolios

Gold has been a focus of discussion recently as its price has risen sharply. While it’s often seen as a timeless store of value, the reality is more complex. To make informed decisions, investors should understand what gold is, why people might want to invest in it and what risks it carries.

What is gold and why do people buy It?

Gold is one of the world’s oldest investments, being mentioned over 400 times in the bible. It has emotional and historical appeal; it’s tangible, rare, and has long been associated with wealth. For many, gold represents a safe haven when markets are uncertain. Central banks also buy gold as part of their reserves, partly to diversify away from the US dollar.

However, gold is not a productive asset. It doesn’t generate income like interest from bonds or dividends from equities. Its price rises only when investors are willing to pay more for it. Unlike currencies, gold doesn’t earn interest, and storing or insuring it comes with costs.

Most gold demand comes from jewellery, with some use in electronics and dentistry. Investment demand can swing sharply, driven by factors like inflation fears, interest rate movements, and geopolitical tensions. Gold’s price can move suddenly, but not always in ways that investors expect.

What drives the gold price?

Gold’s performance tends to reflect a mix of four main influences:

- Inflation and interest rates: When real interest rates (interest rates minus inflation) fall, gold often becomes more attractive since there’s less opportunity cost to holding it.

- Government debt: High global debt levels can increase demand for gold as investors worry about financial stability.

- Geopolitical tension: Wars, trade disputes, or political crises can push investors toward perceived safe-haven assets like gold.

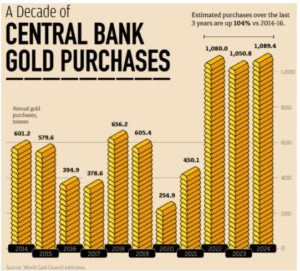

Central bank buying: Some countries, especially outside the West, have increased gold reserves in recent years.

Yet, these relationships are inconsistent. For example, during the 2022 inflation surge and record high purchases of gold by central banks, when many expected gold to rise, its price actually fell. At other times, gold has rallied when inflation was low or when stock markets were strong, showing that it is not a reliable hedge.

The risks of investing in gold

Gold is often seen as a “safe-haven” investment, but history suggests otherwise. Its price is highly volatile, with large swings in short periods. Over some decades, investors have had to wait 30–40 years to recover losses after major drawdowns. For example, those who bought in the 1980s would have seen their investment fall for many years before breaking even.

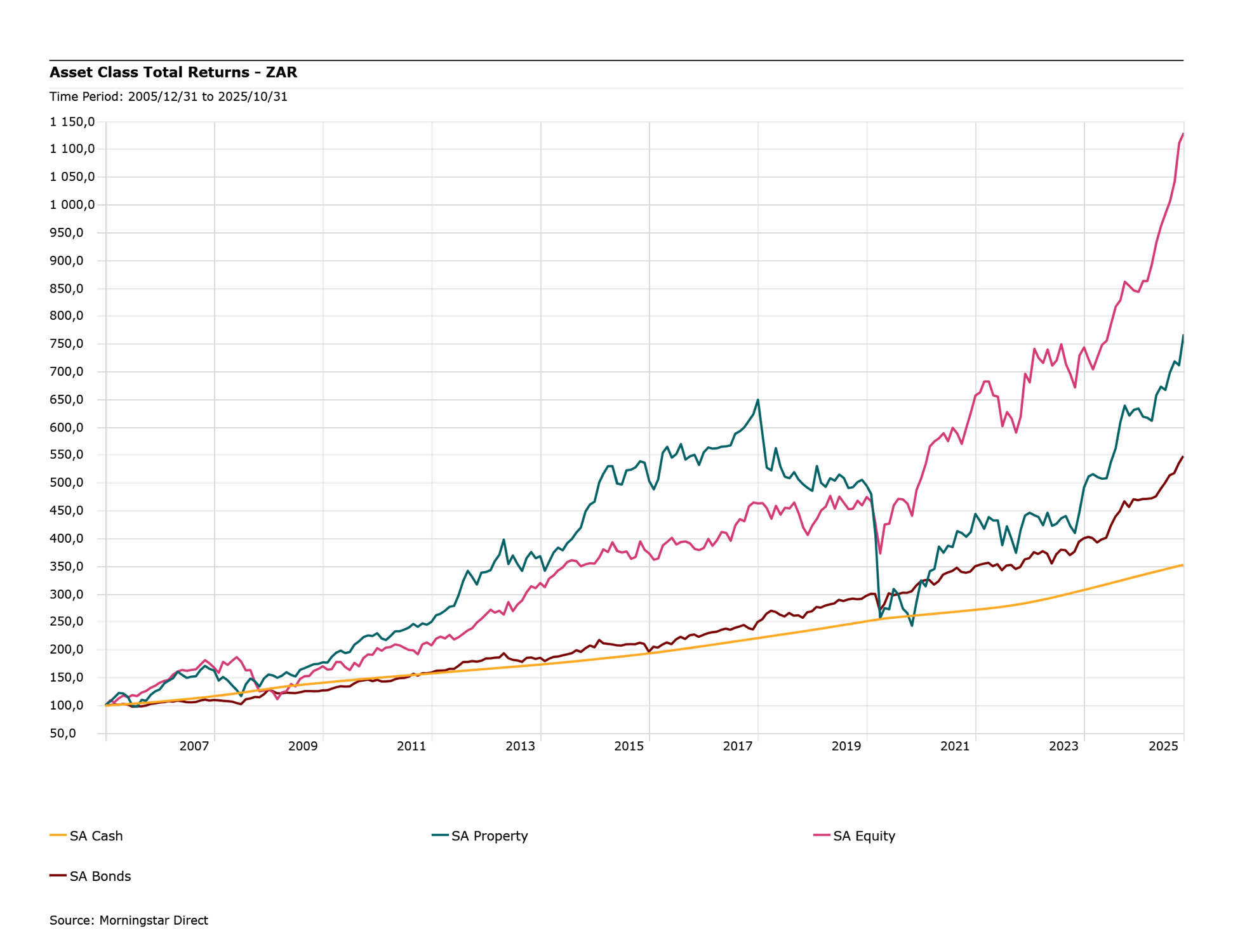

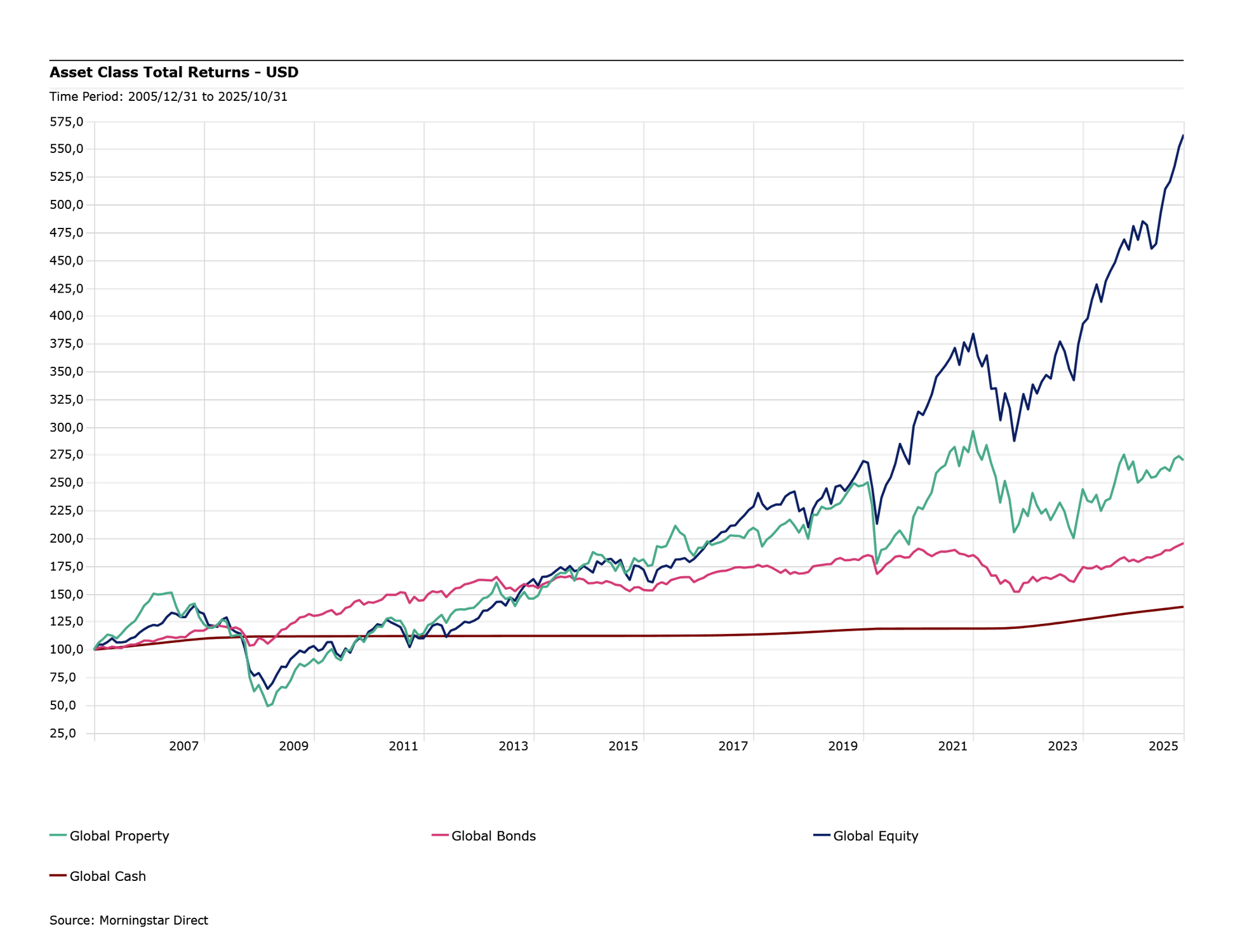

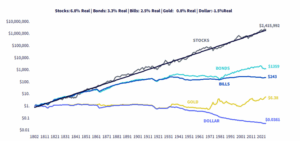

Gold can protect in certain crises, but not all. During stock market crashes, it sometimes holds its value, but at other times, it falls alongside equities. Over long periods, gold has underperformed both bonds and shares. It also offers no income and can lose purchasing power when other assets are rising.

Why PortfolioMetrix doesn’t include gold

At PortfolioMetrix, portfolios are built to balance return, risk, and diversification efficiently. Gold’s characteristics make it a poor strategic fit for several reasons:

- Volatility: Gold’s price moves as much as, or more than, equities, but without the same return potential.

- Unreliable diversification: While gold’s correlation with equities is low, it isn’t consistently negative, meaning it doesn’t always protect portfolios when markets fall.

- Poor long-term returns: Over time, equities and bonds have significantly outperformed gold, while providing income along the way.

- Indirect exposure already exists: Equity portfolios include gold mining companies. These provide a small but partial exposure to movements in the gold price.

PortfolioMetrix prefers to manage risk using assets with more predictable behaviour, such as bonds or cash, rather than relying on gold, which can be unpredictable and expensive to hold. Protecting portfolios is best achieved through sound diversification, not by tactically adding assets that may behave erratically.

When might gold have a role?

For some investors, gold may still hold emotional appeal or act as a small diversifier. A modest allocation might slightly reduce volatility in a portfolio, but may also lower returns without much extra benefit. It’s vital that investors understand why they are buying gold, as insurance rather than a growth driver, and accept its risks and costs.

Gold can look appealing when it’s performing well, but chasing its price often leads to disappointment. As Howard Marks famously said, investing is a “popularity contest” – the most dangerous time to buy is when everyone already has.